Weekend Digest #289: CAAP, Mexico's Foxconn Plant, Femsa

CAAP hits new highs, and multiple updates and developments in Mexico

Summary

Corporacion America Airports (CAAP) hit new all-time highs last week, here's the updated contract news that sparked the rally.

Checking in on CAAP's bidding for new international airport concessions.

Foxconn announces it will build one of the world's largest chip manufacturing plants to build Nvidia chips in Mexico...

Here's the positive ramifications for Mexico in general and for Guadalajara and Pacifico Airports in particular.

Femsa: I'm back to a bullish outlook for Mexico's convenience store giant after its 30% pullback. We also look at its FinTech and hard discounting operations.

CAAP: New All-Time Highs On Favorable Contract Developments

Our Argentine airport investment, Corporation America Airports (NYSE:CAAP) hit a new all-time high last week, crossing the $19 per share mark. There are two reasons for the move.

First, Argentine stocks in general are continuing to rally. As I previously noted, we’ve seen better economic data out of Argentina recently. It appears the worst of the initial Milei economic slowdown has passed. Recall that he fired many government employees upon taking office, leading to an immediate steep slowdown in economic activity as those now-unemployed people curtailed their spending. But it appears the Argentine economy has already bottomed and is starting to turn the corner.

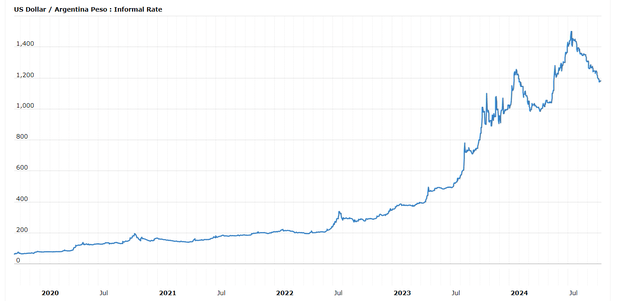

Specifically, we are seeing strength in the Argentine Peso as far as its black market exchange rate goes (lower means stronger peso and vice versa):

Dollar/Arg. Peso exchange rate on the black market. It was around 1,000 when Milei won (his predecessor devalued it more than 50% in 2023 alone printing money to try to buy votes for the election). Since Milei took office, the Peso fell to 1,400 at the height of the first half recession, but has now strengthened to 1,200 as the economy rebounds and inflation abates

This favorable exchange rate move over the past quarter indicates that investors are wanting to keep money in Argentina rather than moving their money out of the country as quickly as possible (the historical precedent with that country).

I want to reiterate that Milei has a difficult road ahead of him, and I am far from certain that he will be able to achieve long-term economic success in Argentina. It’s an exceedingly difficult country to govern. However, he’s on the right path and now the economic indicators are starting to go his way -- so it’s not surprising that Argentine assets are pushing to new highs as this more positive outlook takes hold.

The second factor for CAAP's new highs is specifically that the airport company announced that it has reached an agreement with regulators to update pricing on its Argentine airport concessions. In particular, CAAP will be allowed to charge more than double what it did previously for domestic Argentine routes arriving at CAAP airports. This was exciting news and CAAP stock got a brokerage house upgrade on the development.

I do need to add a couple of caveats here before we get too enthusiastic. Traditionally, domestic is a very small piece of business -- call it 10 to 20%. That's because Argentina does not have a very competitive domestic airline market. There are no other large cities in Argentina besides Buenos Aires, thus limiting the country's internal route selection. The next largest city is about 1.5 million people meaning that you don’t have a huge internal Argentine route driving traffic. You don’t have a Chicago to New York or Los Angeles to New York sort of thing that will be a domestic passenger gold mine. (This is also in contrast to Mexico, where Mexico City-Guadalajara, Mexico City-Monterrey, and Monterrey-Guadalajara are all domestic routes between urban areas each with 5 million plus people that generate tremendous traffic flows day in and day out).

Additionally, Argentina traditionally did not have a discount carrier of any significance. There has been a state run airline which had a near monopoly, leading to high airfares and lackluster service. So, between the lack of other major cities and uncompetitive market, domestic Argentine flying simply wasn’t a big money maker for the airport sector. There are some positive signs now, as Argentina has a discount airline and Milei is deregulating the industry while removing the state from operation of the primary flagship carrier. With more robust competitors, ideally Argentina will have lower fares and thus induce demand and help folks visit places such as Patagonia and Argentine wine country that are far away from Buenos Aires. We'll see.

But, for the foreseeable future, domestic is not a major determinant of how CAAP's overall financial results will be.

The other factor is that this tariff adjustment largely offsets prior depreciation of the Argentine Peso. Even after more than doubling the allowable tariff, we’re still talking about around five dollars per passenger on Argentine routes, which is not too much. It's far better than the two dollars that we were getting previously, but we're still not moving the needle here. CAAP's bread and butter is the $57 per passenger (charged in U.S. Dollars) for international arrivals, along with non-aeronautical revenues from sources such as car rentals, concessions, and advertising. The increase in domestic rates is a good signaling move but won't meaningfully change CAAP's 2025 earnings.

There is an interesting broader point, however. CAAP has a guaranteed 16% IRR on its investments written into the contract with the Argentine government. CAAP has fallen short of reaching its stated contractual IRR for several years (yes, we're highly profitable now, but we should be making even more money -- this truly is the investment that keeps on giving).

This domestic rate adjustment will help marginally in terms of bringing the IRR up toward the contractual framework, but it's still short of where returns should be. So, don’t be surprised if we get a rate increase on international passengers or we get another extension in terms of the years and the remaining concessions so that the Argentine government can make good on the contractual guaranteed IRR. (Recall that the government already extended the Argentine leases from 2028 expiry to 2038 during COVID as a way of making good on lost profits/low IRR during the pandemic, and can utilize that lever again to stay in-line with contractual requirements).

---

Media reports also have surfaced that CAAP is bidding for more airports overseas to expand its portfolio. The company is reportedly one of the finalists for two airports that are up for bidding in Montenegro, this includes the capital city, Podgorica, along with a small touristy seaside town's airport. Neither of these airports are significant operationally -- both are under 2 million passengers annually. Given that Montenegro as a nation has a tiny population and limited tourist flows, neither of these airports would change CAAP's overall financial picture.

But if you get good terms, nothing wrong with adding a couple percent to the company's overall top-line revenues and further diversify the business. CAAP already operates airports in Italy and Armenia, it can handle operations in Europe, and this sort of bolt-on acquisition is fine if the price is right.

Perhaps more interesting is the new airport in Angola's capital city, Luanda. This airport opened at the end of 2023 after a decade of delays. There's been huge investment (by African infrastructure standards) into the property, around $3.8 billion in total. Now that the property is up and running, the government is selling the rights to operate it for the next 25 years.

This one appears that it will be competitive; reportedly, Vinci (Paris:DG), Fraport (Germany:FRA), and a South African company are all interested as well. However, in the event CAAP wins this concession, it could be one with more upside.

Historically, Angola has not been a meaningful airline market. However, Luanda was served by a small outdated airport. Now, it has a glistening new $3.8 billion facility. Luanda itself has more than 9 million people that live there, and Angola is hoping that its new airport will become a hub for Southwest African airline traffic. While the old airport was serving fewer than 6 million passengers per year, in theory this new one could do much more. The airport was built with capacity for at least 15 million today and has plenty of room for future expansion. It won't hit 15 million in the near term, but it's not hard to imagine a pretty big jump from the prior levels.

This could have a pretty big impact for CAAP overall if they win it. CAAP served 81 million passengers in 2023, and Luanda would be in the running for the company's third-largest market (after Buenos Aires and Brasilia, respectively) if it wins this concession. I assume landing fees would be lower given Angola's lower level of development, though Angola is fairly wealthy by African standards and enjoyed GDP growth far above the regional average since 2001. In any case, it will be interesting to see if CAAP can keep piling up more international concessions at reasonably attractive terms in the years to come.

I'll conclude by reminding you that CAAP is fundamentally a different investment type than the Mexican airport operators. The Mexican airport operators generally own mature assets and prioritize cash flow growth which can be distributed to shareholders. Pacifico's CFO, for example, told me that dividend growth was a prime focus in the company's financial planning.

I saw an analyst report suggesting that CAAP would institute a large dividend going forward. However, from my discussion with CAAP's investor relations team, I did not get the impression that a large dividend is in the offing anytime soon. Rather, the company sees numerous opportunities to reinvest capital, both into existing leases (such as Argentina with its guaranteed 16% IRR on invested capital) and in acquiring additional concessions. CAAP likes picking up airports that need structural work (such as the older facilities it got in Italy) and then putting in money upfront to squeeze far more juice out of those assets.

CAAP views itself as being a skilled capital allocator in this regard, and so it can do better for shareholders by reinvesting our capital for us at mid-to-high teens annualized rates rather than paying us dividends. And, it's hard to argue with that logic.

EBITDA has more than doubled over the past five years. Management has earned the right to redeploy capital on our behalf.

To sum up, CAAP should be viewed as a capital appreciation vehicle. It is not an income security; I would not count on it paying major dividends anytime soon, even as its EBITDA and operating cash flows are showing prodigious growth. And, given the share price trajectory, I would imagine that the shareholders are more than happy to let CAAP's management keep doing M&A and building out more airport infrastructure in the years to come.

While I appreciate the new contract agreement on domestic Argentine flights, I don't think it really moves the needle on near-term earnings. And the new contracts (if won) would be beneficial to earnings, but I'd need to see the terms on a finalized Angola deal before adding much value to my overall outlook. So, for today, I reiterate my view that shares are worth $30 over the next 12-24 months and that CAAP remains one of my favorite long ideas.

Foxconn Building World's Largest Semiconductor Plant -- In Mexico

Last week, gigantic Taiwanese electronics company Foxconn confirmed the speculation that it will be opening a new semiconductor factory in Guadalajara, Mexico. And not just any semiconductor factory, but the largest of its kind devoted to GPU units. The purpose of this plant, at least at the outset, will be to build the Nvidia's Blackwell units for AI and data center demand. These chips are already reportedly backlogged for the entire next year, so Foxconn should have plenty of demand to route through its Mexican plant once it's up and running.

From the Financial Times:

"Electronics manufacturing group Foxconn is building the world’s largest factory making Nvidia’s most advanced artificial intelligence servers in Mexico, in a stark illustration of how global technology supply chains are decoupling from China.

The plant in the central Mexican city of Guadalajara will assemble GB200 Blackwell AI servers, Foxconn’s chair Young Liu told customers and partners at Foxconn’s annual technology showcase event in Taipei."

Given the deteriorating relationship between Taiwan and China, Foxconn decided to further diversify its supply chain and picked Guadalajara as the site for its new superplant. This isn't entirely without precedent -- Guadalajara is known as Latin America's "Silicon Valley" and other global chip companies such as NXP Semiconductors (NASDAQ:NXPI) already have some operations in Guadalajara.

Regardless, people have long pushed back against my Mexican manufacturing thesis by saying that Mexico doesn’t have the level of skilled workers and educational system necessary to attain higher quality manufacturing operations.

The idea being that Mexico makes very good refrigerators, washing machines and cars, but that if you need high skill, top-of-the-line precision manufacturing you’ve got to go to a more sophisticated country. I can't tell you how many times people have dismissed Mexico as merely being for assembling basic goods. Sure, Mexico can make millions of microwaves cost effectively but could it ever move up the value chain to higher profit margin goods?

Mexico does have some consumer electronics capacity already in fields like TVs and laptops, so there is some established knowledge around the electronics industry. But it's a big leap forward for Mexico to go from making TVs to the world's single most cutting edge and in-demand semiconductor product. It's hard to overstate how important it is for Mexico to become the leading manufacturer for Nvidia's Blackwell chips going forward -- it's a huge flashing banner to the rest of the Fortune 500 saying that Mexico is the place to go for new high-end manufacturing investments.

According to the English-language media, Mexico is just too dangerous right now with the supposedly radical new president, Claudia Sheinbaum. She assumed the presidency recently, and it is part funny, part sad reading the foreign media reactions. You'd think this lady was a psycho from reading the press accounts. If you look at her actual policies, they’re not too different from Kamala Harris, however. I find it bizarre that some media outlets are at the same time lauding Harris' presidential run while concluding that Sheinbaum is a radical leftist that will crush business in Mexico. I'm no fan of populist left economics, but if you're going to criticize Sheinbaum's brand of European-flavored social democracy, you should also be criticizing Harris' economic plans. All I ask for is equal treatment of these two ladies.

I'll hop off my soapbox though. The important point here is that Foxconn, and by association lead customer Nvidia, are voting with their wallets that Mexico is a great place to do business. You don't build one of the world's largest semiconductor factories unless you are highly confident that it is located in a pro-business jurisdiction. Foxconn is only building in Guadalajara because they know it's a politically stable region with strong institutions and a legal framework that will protect their investment.

Someone should ask Foxconn and Nvidia why are they deploying so much money and supply chain reliance to a region that -- if you read the sensationalist U.S. press -- is being overrun with cartel activity and crime. Are the people at Foxconn stupid? Or perhaps they have better data than some journalists writing reports from the U.S. that have limited at best information about actual conditions on the ground in Mexico.

Mexico has huge variation in conditions from state to state; Guadalajara -- for example, is safe, prosperous and in many ways looks very similar to Texas. Spend some time there and you'll have zero doubt as to why Guadalajara's economy is rocketing ahead. There are other states in Mexico that are highly violent -- not only would I not invest in Guerrero, for example, but I wouldn't even travel there with my wife and kids. Does that mean we write off the whole country though? Of course not, in the same way that simply because inner city St. Louis, Birmingham, or Trenton U.S. have high homicide rates doesn't make the whole United States uninvestable. I'm exceptionally tired of talking about crime in Mexico, but as long as the media keeps trying to drum up stories about it, I must discuss it here. As always, look at what companies are actually doing with their money -- they are building at record speed in Mexico, negative press accounts notwithstanding.

---

Let's zoom in on the benefits to Pacifico Airports (NYSE:PAC), with its Guadalajara airport, specifically. To be clear, there's not much of a direct impact on cargo operations at GDL airport when a new factory opens. You do get some just-in-time air freight, particularly for higher cost items like electronic equipment or medical devices. But, by and large, most of the cargo involving manufacturing plants will be transported by road and rail. Northern Mexico is so attractive to manufacturing, in large part, because it has easy access by both rail and high-quality highways to Texas, Arizona, and California, respectively. Whereas anything coming in from Central/South America or Asia has to come by ship or plane. So no, the big upside to us isn't air cargo.

Rather, the core thesis here is that we'll get a much larger and more prosperous urban area in cities where these new state-of-the-art factories spring up. Let's say a new factory creates 5,000 high-paying jobs. That tends to have a 3-4x multiplier effect; a factory worker has a family, of course. And in addition, for each highly-paid factory worker, you get incremental demand for more nurses, doctors, teachers, retail workers, and so on that provide services to these manufacturing employees' families. So you get a big overall boom in your population as people migrate to a city, not just to work at the factory, but also at other businesses that thrive as the overall economy grows.

And because these factory workers are wealthier, they will tend to have higher disposable incomes which means more money to spend on tourism. A common example is folks moving from subsistence agriculture in Southern Mexico to a factory job in Northern Mexico. In doing so, on average, a worker goes from earning $1/hour picking crops to earning more than $4 per hour at a new factory in Guadalajara or Monterrey. That's a huge increase in income and thus spending power.

It's not just leisure travel either. In addition, you get more business travel. In this case specifically, there will be Foxconn employees coming and going from their HQ in Taiwan, along with customer visits from Nvidia and other chip companies that are contracting out manufacturing to Foxconn. This effect is so pronounced that you've seen Monterrey (Mexico's manufacturing capital) pick up direct routes to cities like Detroit because there are so many business executives going back and forth between their American HQs and their Mexican manufacturing facilities.

Indeed, the most prominent example of manufacturing building prosperity is in Monterrey. Centro Norte Airports (NASDAQ:OMAB), as a reminder, has its flagship airport at Monterrey. Since the NAFTA free trade deal went into effect in the 1990s, Monterrey's urban area population has soared at a clip of almost 75,000 people per year annually. Adding a new 75k people to your catchment area every year is very good for a transportation business. Guadalajara has enjoyed a similar more gradual effect -- though now that Mexico is gaining steam as a technology hub, Guadalajara may see its gains speed up and become more in-line with Monterrey, the latter of which is more focused on manufacturing vehicles and industrial goods.

Enough rambling. Point being that creating high quality jobs with multinational firms is good for business. Mexico is enjoying a unique moment thanks to China's cratering reputation/fortunes. North America still needs cheap manufacturing from somewhere, and Mexico -- for a variety of reasons -- is best situated to fill the current supply chain hole. Despite all the nasty rhetoric about Mexico's government and supposed crime situation this year, follow the money. More and more of the world's leading companies are relying on Mexico for manufacturing, and that will soon include Nvidia and its next-generation AI chips. As long as the new manufacturing plants keep on coming, the Mexican bull market will keep on running.

Femsa: Another Buying Opportunity For Mexico's Convenience Store Giant

Sticking with Mexico, it’s time for an update on Fomento Economico Mexicano (NYSE:FMX) or Femsa as it’s more commonly known. I have owned FMX shares in the buy and hold portfolio since the 2016 Trump election sell-off and added on the dip during the pandemic, establishing a nice low cost basis.

Then, the stock got popular with FinTwit last year, garnering multiple long write-ups and fund manager activity in the stock. This enthusiasm got FMX stock up over $140 at one point, and it appeared the opportunity to invest in Femsa had passed. However, the enthusiasm has faded this year, and Femsa is now back to its traditional pricing around $100/share:

It's remarkable just how much time FMX shares have spent in the $80-$100 range.

With the stock back under $100, let's take a fresh look. For those unfamiliar, Femsa is a Mexican conglomerate that is one of Mexico's most important businesses; it currently has the #2 weighting in the Mexico ETF, only trailing banking firm Banorte.

Femsa originally rose to prominence thanks to its beer brewing business. It sold this to Heineken (Amsterdam:HEIA) in return for 20% ownership of Heineken in the early 2010s. It has subsequently sold down that Heineken position, reinvesting the cash into a variety of other operations. Femsa has also been influential in non-alcoholic beverages. It is the leading Coca-Cola bottler for Mexico, along with having operations in various countries in South America. Femsa now owns half of that soda business, while the other half is publicly-traded via its Coca-Cola Femsa (NYSE:KOF) subsidiary.

Femsa has invested in many other things over the years. By far the most important is its OXXO convenience store chain. It operates more than 20,000 OXXOs across Mexico. They are ubiquitous in the same way that Starbucks is in the US. You can be walking down the street in Mexico and see two or three OXXOs within a five-minute span. Femsa isn’t stopping at Mexico, either. It's now going after South America, it's over 2,000 locations in Brazil and hundreds more in Colombia already. My understanding is that there will be rapidfire store openings across South America in addition to continuing to flood the zone in Mexico.

You might think at 20,000 convenience stores that they've already saturated the market. However, they are largely competing against mom-and-pop tiny neighborhood stores, and estimates suggest there are still more than 100,000 of those across Mexico. It's hard to put an exact limit on the size of OXXO's total addressable market, what we do know is that while they've generally saturated Northern Mexico, there's still a lot of opportunity left south and east of Mexico City.

OXXO is a traditional convenience store format (notably almost all locations are urban settings aimed in significant part at pedestrians and do not sell gas), and OXXOs sell a ton of snacks and beverages, in addition to hot items like hot dogs and tacos. This is fitting, given that OXXO originally existed to provide more points of sale for Femsa's beer and Coca-Cola businesses.

However, the Femsa/OXXO of 2024 is broadening its revenue mix. Femsa is building a large FinTech business, Spin, which is distributed via its OXXO locations. Historically, OXXO has served as a payments location -- you can pay rent, utilities, taxes, and do money transfers from your local OXXO. When I lived in Queretaro, I paid rent via OXXO money transfer several times when my landlord was on vacation. OXXO has worked to become a leading bank to the unbanked.

And now, with Spin, OXXO has a digital wallet/payments platform. Spin offers people cards as well, so they can spend money for e-commerce and digital services without needing a traditional bank account. As OXXO is a leading site for receiving remittances from the U.S., this works very well as family members can receive cash from the U.S. and use it to pay bills and load up their charge cards at OXXO while buying some snacks and drinks as well.

Like most LatAm countries, banking penetration is fairly low in Mexico. Fees are quite high, and lower class customers have tended to feel unserved by large banks. This has given firms such as MercadoLibre, Nu, and OXXO a significant market opportunity. OXXO's Spin, for its part, reported more than 50% year-over-year growth last quarter, passing 10 million customers.

Femsa has more irons in the fire. Since the government deregulated the energy sector to a degree, it has become possible to have privately-run gas stations, and Femsa has entered that market to a modest degree. It also has several pharmacy businesses. Unfortunately, it seems that building and scaling up pharmacy chains both in Mexico and South America has not worked out nearly as well as management expected; the scale benefits simply haven't been there and Femsa's pharmacy business has delivered disappointing returns on capital.

Femsa also bought a convenience store and packaged foods business in Europe a couple of years ago. I was very negative about that deal at the time, the price wasn't compelling and it looked like classic "diworsification" with management looking to add more assets to the business while diluting the core. There have been a variety of other acquisitions -- often puzzling -- over the past decade, though on a smaller scale.

---

However, as mentioned, Femsa stock got popular with FinTwit in 2023. This was directly related to capital allocation; namely that management indicated it would stop engaging in so much M&A and focus on returning more capital to shareholders.

Femsa has long been a complicated conglomerate and traded at a significant "sum of the parts" discount to its purported fair value. I previously argued here that some of those estimates were too high because certain businesses (like pharmacy) were struggling, but in any case, when you put a bunch of different things under one umbrella, you usually don't get full price for the whole conglomerate. Many people would prefer to own OXXO and pay full price for that business but want little to do with several other Femsa holdings.

So, the idea of no more scattershot M&A and some divestment of non-core businesses was exactly what Wall Street wanted to hear. And so, voila, FMX stock doubled between late 2022 and early 2024. It was a good thesis, and I get why folks were eagerly writing it up; after years of empire-building, Femsa's management found religion and would operate for the benefit of shareholders. For awhile, it was a convincing pitch, but in February '24, the tide turned:

So, why is the stock down this year? Arguably, that's due to the latest capital allocation plan, which was announced early this year. Femsa offered up a special dividend and a share buyback program, however, neither of these were as large as the bulls had been hoping for. Additionally, Femsa announced yet another acquisition, this one for several hundred convenience stores located mostly in Texas. This is a logical addition (at least by Femsa M&A standards) as it tags an adjacent market to its Northern Mexico convenience store stronghold and helps build out the remittance/cross-border money operations biz that they are working on.

But bulls had been pitching FMX as a capital return story, and more acquisitions -- even more logical coherent ones -- didn't map onto that. There was a lot of money chasing the capital allocation story, and it seems some folks are losing patience since M&A has continued and the special dividend wasn't as big as expected. Combine with the general Mexican market weakness, and you get a quick 30% pullback off the highs.

I think that makes for a reasonably attractive entry point. Despite the tremendous rally at the end of 2023, FMX stock is now up just 10% over the past five years, which is not much at all considering that OXXO has added more than 5,000 new locations over that span. Put another way, Femsa's annual revenues are up from $27 billion in 2019 to an estimated $42 billion this year yet the share price has hardly advanced at all.

Femsa shares are trading at about 19 times forward earnings (some complexity with that number from all the subsidiaries/JVs but it's about right) which is a more reasonable multiple for the sort of business. This is not some fire sale bargain by any means, but it's more than reasonable for a company that has a long runway for growing top-line revenues at a double-digit annualized rate for many years to come. Shares are also back down to 1.0x revenues and 12x EBITDA, which is fine for a large conglomerate with strong growth prospects.

It's hard to overstate how strong OXXO's market position is unless you've spent time in Mexico. The stores are literally everywhere, and people love them. They're busy, well-stocked, and have pleasant helpful staff. The Spin product is already over 10 million customers and growing at a rapid clip; given how much of the population already shops there, it's only natural to push its digital wallets, payments, and card products to those captive customers. Spin recently got a banking license, and is expected to push into direct lending to its customers as well.

I'd highlight that Spin is still losing money now, from what I've heard, about $150 million annually. Femsa earns about $1.6 billion in annual net income, so the FinTech business is deflating earnings to a meaningful degree as it continues to grow. With such a rapid growth rate, and the possibility of opening up lending products, however, it should only be a matter of time until this division goes from money-losing investment into profit center. Thus, I'd argue FMX stock is cheaper than its apparent 19x forward earnings, as that includes a large currently money-losing start-up which will become a major earnings contributor over the next 24-48 months.

Furthermore, if you were able to IPO Spin as an independent FinTech unit with more than 10 million customers and a top-line 50% growth rate, you'd surely attract a high valuation from the market. Yet, because it is buried inside a retail conglomerate, the sort of people that buy stocks like SoFi, Robinhood, Nu, etc. aren't looking at Femsa. People don't think of Femsa as a FinTech investment. Once it crosses into profitability, however, I expect Spin/OXXO to attract a lot more attention with growth investors.

---

The final attractive element to Femsa today is its hard discounting business, Bara. For U.S. readers, think of Aldi -- or in Europe, something like Lidl or Poland's Dino Polska. The idea being that you carry fewer items, have a minimal number of employees, and make money from turning over your inventory quickly.

This business model has gotten very large in markets such as Germany and Eastern Europe. We've also seen the model start to work in Latin America, for example Jeronimo Martin's (Portugal:JPM) has grown its Colombian chain, Ara, from zero locations to nearly 1,000 over the past decade. Logically, Femsa with its tens of thousands of OXXOs has proven that it can effectively open new retail stores at a breathtaking clip.

There's a particular reason this topic is of interest to us today. That's because Mexican hard discount competitor BBB Foods (NYSE:TBBB) IPOed earlier this year and the stock has been on fire, rising from the IPO price of $17.50 to nearly double that:

People are now paying more than 100 times forward earnings for BBB Foods (that's right, Mexico has an overhyped and overvalued stock, good to see!) Hard discounting, at least for BBB, has proven to be good business in Mexico. But BBB is a small company.

Femsa, by contrast, has more than 20,000 OXXOs in operation in Mexico, along with a variety of other things (gas stations, pharmacies, etc.) so it has far more logistics/supply chain to throw at a hard discount business than BBB. Femsa can take all its strategic advantages from OXXO and use them to help crush this BBB rival along with any other upstarts that go after the hard discounting market.

And, at the same time, if people are willing to pay more than 100 times earnings and 40 times EBITDA for BBB foods that implies that Femsa's version of that business should be worth quite a bit as well. Of course, it suffers from the conglomerate discount -- just as you can't buy pureplay OXXO stock or Spin stock, you can't invest in only the hard discounter portion of the business either. Unless management radically breaks up/simplifies the business (which I don't expect) we will never get full valuation for each of these business units.

That said, when you have the dominant LatAm convenience chain, a FinTech with more than 10 million users, and a fast-growing hard discounter all under one roof, it's not hard to imagine a world where at least one of these units catches the public's eye and leads to a higher valuation.

Of course, there's uncertainty about how Femsa will deploy capital going forward. It's not just the company's uneven M&A track record, either. We also had the CEO leave last year due to health problems. That was followed by both the CFO and COO exiting more recently.

As such, there's fresh blood that will be running Femsa. This means we could get a complete pivot away from their prior empire building. Or we could get more of the same. We may also lose some of the company's prior expertise in opening OXXOs with such incredible inefficiency. This sort of full-scale change in the management suite is a question mark. That said, Wall Street really hated the prior management team's capital allocation approach, so there's a pretty low bar for taking a more investor-friendly approach going forward. For what it's worth, I'm much happier seeing them buying convenience stores in Texas rather than a retail/bakery business in Europe. In my opinion, that's big progress in terms of rationalizing the M&A strategy, but only time will tell.

There's a great deal of uncertainty here on multiple fronts. I can't in good faith make this a high conviction pick at this price because there's so many moving parts. That said, the prior optimism from the hedge fund community has exited out of FMX stock and shares are back to a more reasonable starting price. If anything goes right, be it the new management, the Spin business, the hard discounter, or better-than-expect growth for OXXO internationally and we could get a serious upside move in FMX shares.

I personally will be adding to my position in the buy-and-hold portfolio assuming the stock stays under $100. I think Walmart Mexico (Mexico:WALMEX) is a "cleaner" way to play the growing Mexican middle class theme and I own more of that one than Femsa. But for folks that really like OXXO or the FinTech business' prospects, I can cosign the bullish perspective given the more reasonable starting price on the stock today.

Did $CAAP win the Nigeria contract?