Summary

Market speculation is reaching near-record levels, making it time to consider taking a rare bearish bet.

The ARKK ETF is a concentrated basket of overvalued speculative meme-driven stocks with no compelling long-term investment case at current prices.

A surge in new IPOs and equity issuance is diluting capital, echoing past bubbles, and setting the stage for a sharp correction in speculative assets.

A defined-risk ARKK put spread offers an attractive risk/reward (better than 3:1) in the event that ARKK corrects over the next six months.

It's time to take a swing at the dark side.

In the five years of running the aggressive portfolio here at this publication, I have only rarely taken bearish market positions.

Needless to say, market conditions have been unfavorable for short sellers ever since the government started turning on the money spigots in the wake of the pandemic.

Back in 2020/1, we had a ridiculous run across tech, e-commerce, NFTs, and SPACs to name a few of the more egregious examples.

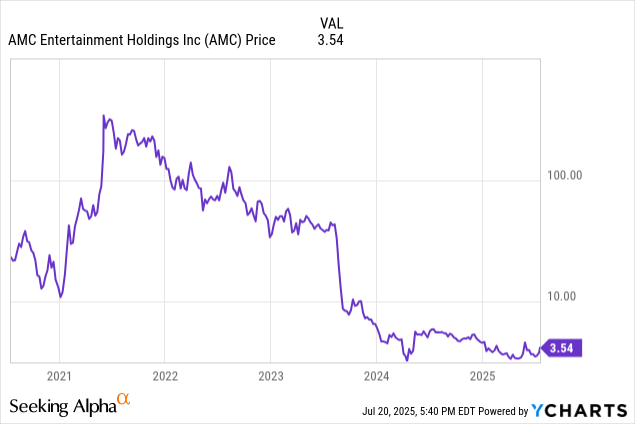

It would have been reasonable to assume that the large losses in 2022 would have taught investors about the dangers of growth-at-any-price "investing". Buying things on memes and vibes is not a positive expected value play. Even "leading" first-generation meme stonks like AMC are now trading far below where they did before the 2021 shenanigans began:

Have fun staying poor, indeed.

But the lessons of 2022 have long since been forgotten.

The equity and crypto markets have ignited another wave of speculation that is equally as ridiculous as 2021 was.

The market structure inherently favors the bulls (constant stimulus, politician jawboning, rate cuts, etc. any time the market drops) along with how deeply ingrained the buy-the-dip ideology is at the moment. Given this, it's been pointless to have a structurally bearish view on U.S. stocks for many years now, and why I've avoided shorting the indexes outright in my portfolios here even though they have been overvalued.

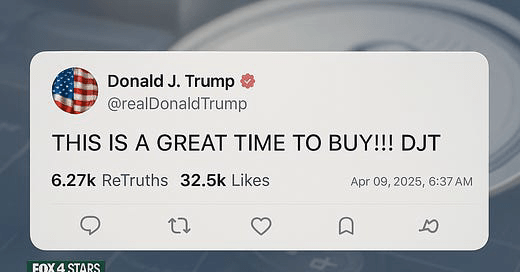

And we now have an administration that openly talks about higher stock prices:

I won't even get into the various White House crypto launches, MAGA-related SPACs and investment funds, and the list goes on, beyond noting that the president's media company, Trump Media, now owns $2 billion in bitcoin:

The powers that be currently are giving the green light to market speculation and have also throttled the SEC, CFTC, and other regulatory bodies which would crack down on unscrupulous actors. Whether or not you agree with that, it is what it is and there's no point in whining about it. Trade the market in front of you.

Needless to say, this is a dangerous market to try to short in general. And in particular, betting against sketchy and speculative companies is increasingly fraught since if a company engages in accounting fraud or misrepresents its operations, there is less of a chance of the SEC attempting to bring an enforcement action under current leadership.

Since the initial recovery from the pandemic, I've held the view that the flood of easy money has distorted financial market behavior. And after a brief respite in 2022/3, things have gotten particularly silly once again.

That said, I haven't tried to short the market or individual meme stocks to any considerable degree. Just because you can identify a bubble doesn't mean you should try to short it; at least while it is still inflating.

That decision has proven sound. This publication's aggressive portfolio is now up 211% since inception (Jan. 2020). There's plenty of money to be made without either owning or betting against meme/momentum junk.

I have owned some stocks which have benefited from meme/short-term trading, such as our recent 70% gain in Unity Software (NYSE:U).

However, my strategy has not and will not rely on trading meme stocks or overvalued growth nonsense to generate the bulk of returns. There are plenty of other places in financial markets to make more than adequate returns on investment.

Why It's Time To Take A Bearish Shot Here

All that said, I do believe we are nearing a point of what could charitably described as maximum stupidity. And, as such, it's worthwhile to consider taking a bet against the current retail trader euphoria.

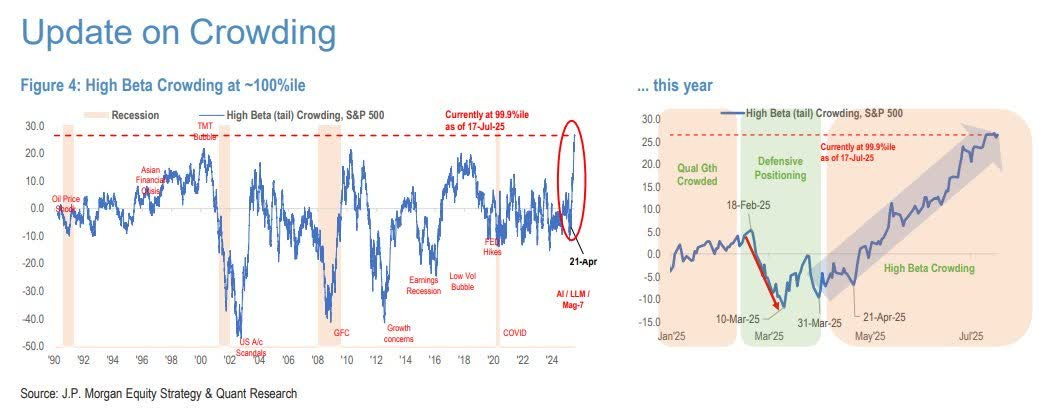

High beta stocks are now at 100% percentile exposure compared to past 35 years of data. If you were ever going to fade it, you have to at least think about it here.

I would reiterate, however, that I'm in no rush to bet heavily against individual companies with retail trader cult followings. The market is full of bears who are intellectually smart but have gotten steamrolled trying to short Tesla, Palantir, Robinhood and many other meme stocks with little actual underpinning beneath their valuations.

Companies like Tesla have proven to be impervious to fundamentals -- a stock like Tesla drops far more when Elon Musk gets into a social media fight than when Tesla reports dismal sales numbers. I got blocked by a fair number of the TSLAQ (Tesla short sellers) community on Twitter back in 2019-20 for saying that trying to short Tesla was a waste of time since it's a barometer of how retail traders feel about Elon Musk. Fast forward to 2025 and that's still been true.

I'm not going to argue that this is the time to take individual bets against names like TSLA or PLTR, at least unless they are hedged with longside exposure and position sizes are manageable.

However, we can get exposure to shorting the basket (factor) of retail trading/momo/meme nonsense without taking the risk of any one individual stock blasting off exponentially.

--

The easiest way is through ETFs. What we want to do here is isolate the meme or speculative factor.

There are various different ETFs that we could target for a short sale operation. For example, niche sector ETFs in frothy parts of the market -- think space, quantum computing, and so on.

It's almost inevitable that when a bunch of retail money flows into niche themes, you'll get a big sell-off sooner or later. Past examples here include 3D printing, marijuana stocks, and lithium mining.

You could short some of the ETFs that are focused on factors, such as momentum-flavored or high beta strategies. These tend to end up owning a lot of the magnificent seven stocks, however, and I see little reason to try to bet against AAPL/GOOGL/NVDA/MSFT type stocks here. If you want to do that, just short Nasdaq or S&P futures.

I want more concentrated exposure to the filthiest, most degenerate, most inexplicable garbage.

Which leads to the ARK Innovation ETF (BATS:ARKK).

This is Cathie Wood's flagship fund. Wood was incredibly successful at gathering funds at the onset of the pandemic. ARKK skyrocketed as capital flowed in and at one point it was the largest actively-managed ETF in the United States.

ARKK owned many of the lowest-quality most ridiculous stock speculations of 2020 and 2021. This was incredibly successful on the way up, as she attracted assets at lightning speed. Each day, she would get more money with which she could hit the ask and cause the value of her frothy speculative names to surge. Retail traders view price as the ultimate determinate of value, and so as prices went up, it "confirmed" that the "thesis" was working, be it that Zoom Communications and Moderna were revolutionary companies worth $500/share, that telehealth was going to make doctors' offices obsolete, or the many other such ideas people had while they were couped up at home.

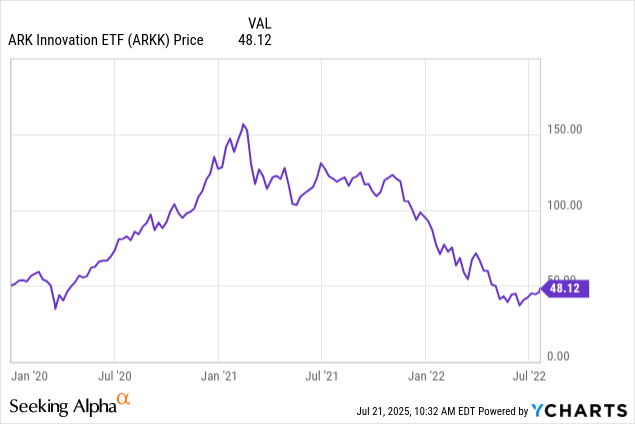

We all remember what happened next:

ARKK 2020-2022 share performance.

ARKK peaked in early 2021 at $160 per share. Within a couple of months, it had touched $100. It consolidated around there until year-end 2021, and then it proceeded to plunge another 60% over the next six months.

--

ARKK is not as large now as it was then, but it still has a more than respectable $7.5 billion in assets under management.

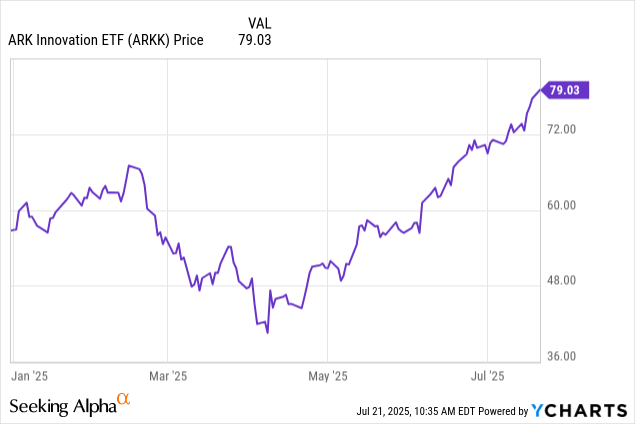

And the retail enthusiasm has worked out well for her, with ARKK shares doubling since April. To reiterate, this is an unleveraged ETF that has doubled in three months:

Her portfolio now is a solid cross sampling of low-quality crap which has been levitating thanks to recent market conditions. Just take a look at the top 10 holdings:

Tesla Inc

Coinbase Global Inc

Roblox Corp

Roku Inc

Circle Internet Group Inc

CRISPR Therapeutics AG

Robinhood Markets Inc

Shopify Inc Registered Shs

Tempus AI Inc

Palantir Technologies Inc

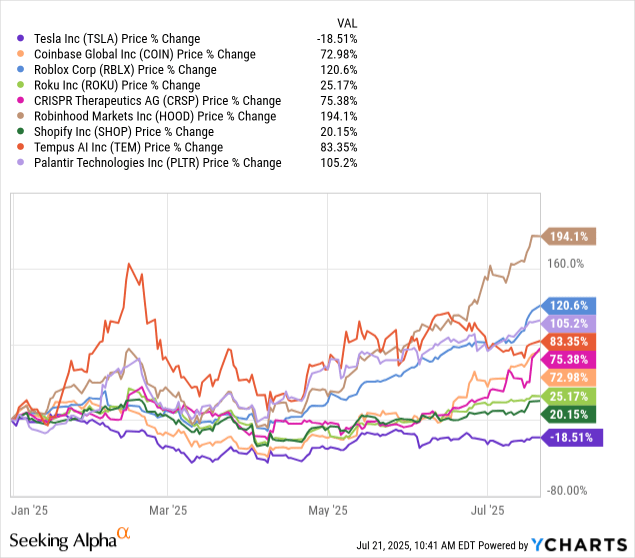

And here's a chart of these year-to-date (excluding Circle which IPOed recently):

Setting aside Cathie Wood's obsession with Tesla, which is now dragging down her returns, the rest of this is peak portfolio allocation if you're wanting a momo/growth-at-any-price/vibes-over-valuations strategy.

There is not a single one of these that I would consider being anywhere near fair value or having an investable bull case at today's price.

Just think about a few of the top names:

Tesla is not a real investment (11x sales/180x earnings for a car company?!?). That said, it may not be a good meme now either as Musk is feuding with Trump, the U.S. is cutting off EV subsidies, and Tesla faces existential risk from cheaper Chinese EVs.

Circle - They run a service which allows crypto traders to sell their BTC or ETH and get Circles (valued at $1) rather than USDs, which makes life a little easier for crypto traders. Circle collects these deposits/funds at 0% interest, lends that out to the U.S. government at 4%, and profits. Gamblers are now paying 125x earnings and more than 10x revenues for this extremely simple banking model. Just lol.

Coinbase - How exactly are these guys charging such absurd commissions in a time when you can buy crypto exposure via ETFs or one of the dozens (perhaps hundreds by the time I hit publish) of crypto treasury companies. Coinbase had a quasi-monopoly as you had to either use them or shady offshore exchanges. Now you don't. Their commissions will collapse to zero (a la stock trading fees over the past decade) and EPS will plunge with it.

Tempus.ai - Cathie Wood's sweet spot -- a smaller market cap healthcare company with black box tech no one understands trading at an absurd multiple in large part because she is buying it.

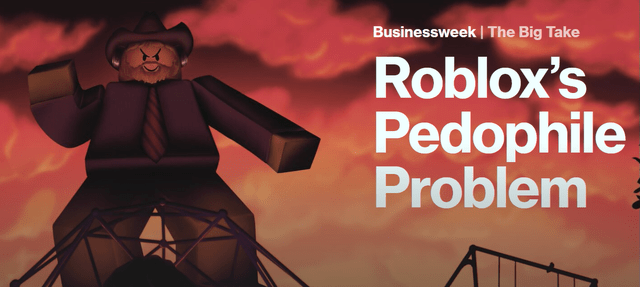

Roblox - Unprofitable video gaming company that caters to children and reportedly permits all sorts of sleazy and sexually explicit content toward said children.

Putting that aside, an $85 billion market cap for a "gaming" company with awful games, non-existent graphics, and few users over age 13 is quite the thing.

CRISPR Therapeutics - Oh hey, another healthcare company, this time with $860,000 of revenues last quarter, promising huge things in gene editing. Good luck!

I could go on through the rest of the holdings, but you get the point.

ARKK is greater than the sum of its parts -- a bunch of lousy companies individually, but, in aggregate, a perfect mix of everything that has retail traders going crazy at the moment.

--

So, why short now?

After such a huge run, now would be a natural time for the market to pause. And we're approaching September and October, which are two of the weakest months for the market seasonally, and have often been when big corrections occur.

More importantly, we've seen a huge amount of new equity issuance. New IPOs, new secondary offerings, new crypto launches, new convertible bonds. It's all flying out the door right now. Just look at the investment banking profits for companies like JPMorgan and Citi this quarter -- they are printing money doing deals right now. As the saying goes, you feed the ducks while they're quacking, and has Wall Street been feeding the ducks indeed.

We've had a bunch of high-profile IPOs of very ridiculous companies. Coreweave, for example, which I've already discussed previously. The business model is absurd on the face of it. Buy high-priced infrastructure, rent it out at a loss (after counting depreciation which very much is a real expense for GPUs that only last five years!), and then borrow more money at double digit interest rates to "scale up" this "business model". Just laughable that this company exists and managed to go public. Coreweave will look as silly in 2035 as Women.com, Boo.com, Pets.com, and CMGI did in the aftermath of the dot-com implosion. And I've already mentioned Circle above, which is one of the more absurd quasi-bank IPOs of the ages.

Regardless of the merits of each of these individual IPOs, in aggregate, they add up to a ton of new supply of stock hitting the market which ties up investor capital which would otherwise be invested in previously existing public equities.

And obviously, the window is wide open to bring more IPOs to the market. For example, over the weekend, news emerged that a crypto company named Bullish is going public:

They don't ring bells at the top, but if the market in junk stocks peaked the moment a company named Bullish filed to go public, it would be fitting.

Meanwhile, among companies that are already public, memes and outright scam stocks are going absolutely ballistic. Look at something like Opendoor Technologies (NASDAQ:OPEN) which is an absolute pile of garbage. It's lost $4 billion since inception on its money-incinerating home flipping venture. It continues to lose about $300 million annually and recently disclosed that it has greatly slowed the pace of its house buying since its inventory of existing homes is skyrocketing.

Most of their competition, including more sophisticated peers such as Zillow and Redfin, already gave up on home flipping (aka iBuying) because they lost money on it in 2020-21 which was arguably the greatest market conditions ever for home flipping. If it didn't work then, why on earth would it work now with sagging house prices and 7% mortgage rates?

No problem to the hedge fund managers that are openly and brazenly tweeting that they are pumping and dumping OPEN stock because ... drumroll please... it's the next Carvana. No one is even doing a semblance of actual research now, it's just one meme/ponzi stonk could go up because another meme/ponzi stonk did. In any case, OPEN stock has rallied as much as 800% in recent days and traded more than 1.3 billion (with a "b") shares on Monday. Retail is betting big on absolutely worthless lotto tickets and once they stop winning, the reversal could be fast and furious.

--

We also have the crypto treasury companies. Apparently, it was decided that Microstrategy (NASDAQ:MSTR) was having too much fun by itself so we've now had more than 50 companies over the past two months started buying Bitcoin, Ethereum, and other less reputable crypto assets. Everyone is planning to run the same game plan, issue endless quantities of stock to buy more crypto.

This worked well for Microstrategy when it was the only company doing this; it will have far less inspiring results when dozens of people are running the same gameplan (and also crypto ETFs now exist so there's no need for a crypto-owning equity vehicle in the same place.) Regardless, if your company is a failed biotech, mining company, or other such small-cap name, it's time to pivot to crypto. Be the first to start loading up Dogecoins or Fartcoins or whatever is the flavor of the day. Why not?

--

With so many new get rich schemes now clamoring for the retail traders' attention, however, it dilutes the market.

The iron rule of capitalism is that you solve price imbalances by adjusting supply and demand. Demand for speculative assets is currently too high, so we're unleashing an unlimited -- literally unlimited in the case of crypto -- quantity of new supply to meet demand. Market participants don't realize at first the amount of dilution/inflation occurring in their beloved gambling sardines, but it soon becomes apparent. Just as the markets for pot stocks, NFTs, SPACs, and dozens of other such previous fads collapsed in the wake of excess supply, so too will the current thing.

--

The market is getting flooded with new issuances across the board. And the SEC is currently doing very little to regulate or rein in questionable new securities.

For a less obvious example, look at the dozens of new Chinese pump and dumps that keep getting listed on the Nasdaq without any pushback.

Combine euphoric market conditions with a regulator that is asleep at the wheel and you get a torrential deluge of new stock issuance to the public. Things are wide open for grifters and scammers to absolutely flood the zone.

--

As a final point here, retail traders seem convinced that the Fed will be forced to cut rates and that this will cause the market to blast off. An analogy to 2000 is apt here. Arguably, the final part of the dot-com boom was due to money supply -- the government pumped in fresh dollars to the system ahead of Jan. 1, 2000 (Y2K) due to fears to a potential widespread computer outage which could have frozen up the financial system.

Y2K ultimately had no material impact on IT systems, but the new money injections did. It served as stimulus for the final push into worthless dot-com dreck. The speculative stocks peaked two months after Y2K and crashed thereafter.

Traders seem convinced that Powell will either give in to rate cuts or get fired and be replaced with someone who will unleash tons of new liquidity on the market. When you're trading hot potatoes, rather than actual assets with underlying value, the focus is always on finding the next dupe who will buy from you at a higher price. Everyone seems convinced that Fed cuts will create this greater fool who will pay $250 for PLTR, $10 for OPEN, $250,000 for Bitcoin and the list goes on.

When it becomes clear that the Fed isn't going to slash rates (or worse yet, Powell gets fired and interest rates go up because it undermines the credibility of the U.S. reserve currency), this illusive greater fool buyer theory will be disproven and people may rush to dump their bags.

Why ARKK Put Spreads Are A Great Way To Capitalize On This Opportunity

We could document signs of market insanity and I'm sure someone will write a great book highlighting all the absurdities going on right now. But I'll leave that for someone else. We've established that the market is unusually euphoric here and that ARKK is a great basket of stocks for expressing this enthusiasm.

Why buy put spreads instead of just shorting ARKK outright? Let's get into the specific trade dynamics here.

Keep reading with a 7-day free trial

Subscribe to Ian’s Insider Corner to keep reading this post and get 7 days of free access to the full post archives.