Mexican Stock Exchange: Deeply Discounted With Multiple Catalysts

The Mexican stock exchange is selling near 5-year lows, it won't be available down here for long.

Summary

The Mexican stock exchange had a down year in 2023, primarily due to foreign currency exchange effects.

Investors have dumped BOLSAA shares to multi-year lows in a dramatic overreaction to this minor event.

Company is trading at 13x earnings and a 7% dividend yield, which seems much too cheap for a monopolistic stock exchange biz with 57% EBITDA margins.

There are multiple catalysts for upside including as many as 10 new IPOs, pension reform, and rising fixed income listings in Mexico.

Since selling Alsea (Mexico:ALSEA) (OTCMKTS:ALSSF) out of the aggressive portfolio, I've been looking for a replacement Mexican stock to take its position.

My thinking has been that as the bull market develops in Mexico, certain stocks will come in and out of favor as the economic expansion proceeds.

Alsea, as a restaurant operator, was a great way to play the "early" stage of the bull market. A robust economy quickly puts money in consumers' pockets and leads to strong spending on discretionary things; that gave us strong comps at things such as our Starbucks and Domino's Mexico locations.

Now that Alsea shares have tripled, however, the valuation there is more reasonable and in-line with international quality restaurant stock peers. Alsea can continue to grow from here, and I continue to own shares in the buy-and-hold portfolio. However, the fast money has been made on the first wave of consumer discretionary names that pop in the beginning stages of a bull market/rising economy.

As a bull strengthens, there should be some rotation in the winners, with other firms taking the leadership going forward. For one example, financial services tend to perform better once an economic expansion is well under way and the amount of financial activity in an economy surges. Which brings us to today's topic, the Mexican stock exchange aka Bolsa Mexicana de Valores, hereafter "BMV" (Mexico:BOLSAA) (OTCMKTS:BOMXF).

While the Mexican equity index has been soaring, that has not translated -- whatsoever -- to the stock exchange so far. Just look at this 5-year chart:

This isn't quite as bad as it looks at first glance due to the massive dividend and also the fact that the Peso is up about 20% versus the Dollar over this stretch. Still, this is a fairly shocking chart given the strength in the Mexican economy.

So, let's get into it. What's the business, and why are shares trading down here in the low 30s?

BMV is the dominant stock exchange in Mexico, with more than 80% market share.

The bull case for this business is exceedingly simple.

Stock exchanges are wonderful businesses; they earn high profit margins and serve as effectively monopolistic businesses. They enjoy strong network effects, and are increasingly benefiting from new ancillary revenue streams such as data sales and software & services.

I own or have previously owned quite a few different stock exchanges; the sector is one of my favorites. As history has proven, financial markets tend to rise in value over time, and owning the houses that process all that trading activity should be a winning business model over the long-term.

I'm upbeat on the business model in general, and BMV's numbers in particular jump right off the page. Specifically, shares are selling for around 13 times earnings and the company offers a 6.4% dividend.

Note: BMV pays an annual dividend. This year's annual payment goes ex-divi at the end of next week and will be paid on May 15th so anyone wanting this year's installment should act now. The company will be paying 2.12 MXN per share for this year, which amounts to a 6.4% dividend yield on today's stock price.

This seems like an oddly cheap valuation given that Mexican stocks have been going straight up, rising 136% (in USD terms) over the past four years and easily outpacing the S&P 500:

A number of people have messaged me asking why I didn't own BMV shares already.

However, long-time readers may remember that I recommended this company in 2020 in this same aggressive portfolio.

The valuation wasn’t quite as cheap as it is now, but the rest of the bull case was quite similar to today. I ultimately sold the stock at breakeven in 2021 when I concluded that my thesis had been wrong, or at least premature. Fast forward three years, however, and the share price has dropped 20% (in Pesos) while the bull case has improved.

To see this evolution, let's consider the things that bugged me about BMV when I sold the stock in 2021:

New rival stock exchange

No new listings on the exchange

No retail interest in trading Mexican stocks

The first concern was Mexico's new stock exchange, the Bolsa Institucional de Valores "BIVA". BIVA launched in 2018, ending the BMV's 43-year monopoly on Mexican stock trading.

Between 2018 and 2020, BIVA enjoyed strong market share gains, and there was the possibility that the pandemic/remote work could drive more adoption to their exchange as well. If BIVA had been able to siphon off a major chunk of trading volume and listings, it could have been a major blow to the BMV. While duopolies are still attractive business models, a monopoly is better, all else held equal.

BIVA gained more share in 2022 and 2023, but the market has steadied over the past year. BMV's market share has stabilizing in the 80-85% range in recent months.

BIVA still exists and is a legitimate threat to BMV's operations. However, it appears set to be a minor exchange and not something that will get to more of a 50/50 split with BMV; also, at least so far, there hasn't been a race to the bottom on pricing or fees.

I remain somewhat concerned about BIVA and will be watching the competition closely. That said, so far, it appears to be more of a nuisance than an existential threat to the BMV.

When I sold BMV shares in 2021, I was also concerned that Mexican stocks had been dead in the water since 2014. That can be fine in isolation. However, trading volumes have been depressed and I was concerned that they might remain stuck in the mud given the complete lack of popular interest in Mexican stocks.

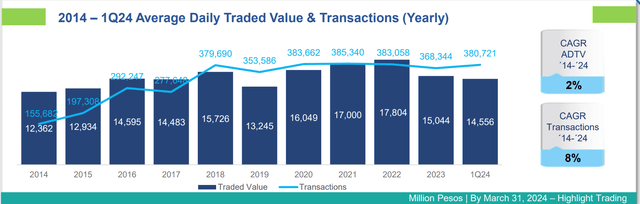

That's largely remained the case; despite a strong rise in prices, both transaction volume and average daily trading volume hasn't increased meaningfully since 2018:

Indeed, it turned out that things such as Mexican airports and fast food chains were far more reactive to the green shoots in the Mexican economy than the financial sector. While Mexican consumer spending has soared, the stock market has remained in the doldrums, with 2024 (through Q1 anyway) looking like another underwhelming year for the BMV.

There is one extremely positive development, however, that has so far not garnered any international attention:

It appears that a Mexican retail trading boom is just starting to kick off. Turns out that when share prices soar, you have a pandemic (people locked up at home looking for new income streams), and a bunch of new brokers/FinTech services enter a market, you get all sorts of new account activity.

Are these retail folks trading much? Not yet. But the accounts are there and over time, if and when prices continue to rise and Mexicans have more disposable income, this should lead to a robust increase in trading activity.

Coming out of the pandemic, my other concern for the BMV was that Mexico has had essentially no new stock listings for a decade. In fact, in many years, more companies have delisted than IPOed on the exchange, reducing the number of active issuers.

Progress remains slow on this front. The BMV attracted two new equity issuers in 2021, one in 2022, one in 2023, and one more so far this year. There have been several other new issues in areas like MLPs and REITs, as well.

What's interesting, however, is that the listed debt market is growing much more quickly.

Thanks to the reshoring boom, you’re seeing a ton of interest in Mexican debt -- and corporate issuers in fields like REITs, infrastructure, and manufacturing are eager to get more capital to expand.

Notably, BMV has enjoyed a sharp uptick in listing fees related to corporate debt even with the Mexican Central Bank putting interest rates up to 11.25%. That companies are eager to borrow in such a capital-constrained market speaks to the amount of pent-up demand for new investments in Mexican industry and infrastructure.

If the credit business is going well now, imagine how well it will be going once the Mexican Central Bank starts really slashing interest rates (first cut already happened recently, by the way). I expect something along the order of 300 basis points of rate cuts over the next 12-18 months, which should greatly increase activity in the Mexican credit markets and improve BMV's performance as well.

The combination of the best Mexican economic conditions since at least 2013 with a sharply declining interest rate should turn the gushers on as far as corporate borrowing goes. (I'd note that this isn't just good for BMV, it's a massive bull case for all things Mexican -- a company like Rotoplas can sell a lot more water tanks when credit is flowing freely).

As for BMV specifically, you get more annual maintenance fees for everyone’s listings with all this new paper coming to market. And there should be increasing trading activity as well. BMV operates a considerable futures market which allows institutions to hedge things such as the Mexican Peso/US Dollar exchange rate. A rise in corporate borrowing/investment should also spur more hedging and so on... there's a virtuous cycle here for financial assets as economic activity accelerates.

I understand fixed income, however, isn't as sexy of a market, even if the checks cash the same. What people want, however, is new equity listings.

And, finally, there is good news on that front. From Arnaud T, who writes about Mexican start-ups, we have this:

Mexican companies are actively preparing to go public According to Raúl Martínez-Ostos, Head of Barclays in Mexico, the activity is spurred by the success of recent listings, as Tienda 3B and Vesta, and a growing interest from global equity investors.

He recently told Bloomberg News that up to 10 IPO deals are underway, with potential listings either in Mexico or the United States.

As it seems, investors remain confident about the country's economic stability under the potential new government, and perceive Claudia Sheinbaum as more business-friendly than the outgoing president.

Investor enthusiasm is also buoyed by the strong performance of the peso and the Mexico’s increasing appeal as a nearshoring hub.

The IPO in either Mexico or U.S. bit is a concern -- hopefully these companies will either list in Mexico or dual-list with a Mexican and U.S. ADR set-up. Firms just listing on the NASDAQ alone doesn't do much for the thesis here.

Regardless, the bigger idea is that Mexican companies are finally going public again. For a decade, almost no Mexican firms wanted to issue stock because the market was offering rock bottom valuations. Who wants to sell at the lows?

Now that Mexican stocks are soaring, though, the opportunity is ripe for companies to finally start bringing in outside public shareholders. And like with many corporate trends, once one or two companies have highly successful IPOs, a whole bunch of other CEOs and founders will want to cash in as well.

Going back to my timing discussion above, the moment when a bull market gets hot enough to open the IPO window is when you are seeing a real evolution in the market. I believe the first wave of the Mexican bull run has played out and now we're moving into the second stage with a different set of winners; the financial actors have realized that Mexico is now a place where you can make real money, and they are changing their behavior accordingly. And the BMV should be central stage for this new activity.

A related benefit to these new IPOs is that it deepens the Mexican market. I've long complained that liquidity is exceptionally sparse on Mexican companies that aren't constituents of the Mexican large-cap index. There simply isn't much in the way of sector ETFs or anything else that would drive activity in smaller Mexican listed companies. As the number of Mexican stocks goes up, however, you can slice and dice them in more directions; hopefully we will see Mexican dividend ETFs, Mexican small-cap ETFs, Mexican growth and value ETFs, and so on in coming years, leading to more capital formation and trading activity for the BMV.

Mexico also has a decent tech/start-up scene. There's some talk that Mexican tech companies will finally start listing on stock exchanges (either U.S. or Mexico). This would make Mexican stocks a more dynamic arena (the perception, rightly or not, is that Mexico's exchange is a stuffy one full of banks, telecom, food companies, and other such slow-movers).

As more dynamic tech, healthcare, and industrial firms go public, more international banks will start covering Mexican stocks and deploy additional analysts to that market.

What's It Worth?

Normally, I'd write a lengthier view on possible upside in the stock.

In this case, however, I'd argue the bull case is quite simple. Today, we can buy at a cyclical trough of earnings and EPS should be straight up from here.

Buying on 13x depressed earnings for a fantastic business (57% EBITDA margins!) with a near monopoly and multiple positive catalysts usually results in a favorable outcome. BMV has no debt, either, meaning this is even cheaper than it looks when compared to levered companies.

And let's discuss the cyclical trough for a minute. I'd highlight the company's most recent report. Despite having a diversified stream of revenues across seven categories, there was weakness on almost all fronts:

Note that "others" included revenues from the sale of real estate, overall revenues would have been down excluding that.

This looks pretty rough, with only OTC Mexico trading, listing fees, and data sales showing meaningful growth out of all segments.

Do note, however, that the BMV charges in dollars for quite a few of its services, meaning it was facing a 15% drop in revenues last year simply due to the Peso appreciating against the U.S. Dollar. Derivatives trading (dollar hedging) also drops in importance in the face of a strong Mexican Peso. So a stable (or outright weakening Mexican Peso) will resolve problems on several of BMV's key revenue lines.

Meanwhile the influx of new corporate debt listings (and soon, up to 10 equity IPOs), will both increase listing fees (already happening) and increase maintenance fees going forward.

BMV's information services business is growing quickly, and should pick up steam as overall activity on the BMV's markets continues to increase. The securities depository (the largest total revenue line) should rebound as well; it benefits from higher asset prices/AUM and any uptick in trading activity will lead to highly favorable results from that segment.

In addition to the generally rising prices of Mexican financial assets, the upcoming rate cuts, and the pending IPOs, there's another positive catalyst as well.

From the BMV slide deck, page 25.

To summarize, the Mexican pension system is set to hike contributions from 6.5% to 15% over the next seven years. As the chart shows, this change is expected to help lead the pension system to go from managing low 20s percent of GDP today to more than 55% of GDP over time.

As a reminder, the entire Mexican equity universe is just $566 billion in total market cap today (32% of Mexican GDP). This is an abnormally low number by global standards. As Mexico continues to modernize and grow wealthier, much more money should find itself chasing Mexican equities (and fixed income) leading to both higher valuations and a flood of new IPOs, both of which are good news for BMV.

Finally, there's the income angle. BMV is committed to paying out 80% of its earnings as dividends. Despite the sluggishness of the Mexican equity market in recent years, the company has grown earnings and dividends a bit, with the exception of this year:

I believe the recent drop in the stock price is from folks overreacting to the sequential drop in 2023 numbers, even when there are obvious factors (such as the huge depreciation of the U.S. Dollar/rise in Mexican Peso) that explain most of this.

We already see listing activity climbing significantly, and the flood of new upcoming IPOs is likely to fully flip sentiment back into the positive. Earnings should easily be above 3 MXN pesos a share as the company returns to its usual EBITDA margins (59-60%) and top-line revenue growth reasserts itself. Throw in more trading activity/listings and closer to 3.50 MXN pesos a share of earnings is well within reach.

Figure an 18-20x P/E multiple on that and we get to a stock price in the $58-$65 range over the next couple of years compared to $33 now. With the 80% payout dividend policy, dividends will be above 2.50 MXN peso a share over the next couple of years, resulting in an at least 7.5% dividend yield on today's entry price.

---

Finally, I'd note that I am buying the stock on its Mexican listing BOLSAA for both the aggressive and buy-and-hold portfolios. I would feel slightly disloyal writing about the Mexican stock exchange as an investment and then routing my ownership through the U.S. Pink Sheets.

That said, for people without access to the Mexican market, there is an unsponsored ADR under ticker BOMXF. Liquidity is pretty thin, but I'd imagine you should be able to buy at least a small position that way. The share ratio is 1:1 so to find the "correct" price for the ADR, simply take the Mexican share price and divide by the exchange rate (33 and 17.0, respectively, at the moment). This results in an implied price of $1.94 per BOMXF share, and indeed, its last trade was $1.95.

Great article, Ian.

A couple small additional thoughts:

1) If you believe (like I do) the next decade will be a fairly inflationary one, owning stock exchanges traditionally are a good way to protect oneself. (By way of example, Horizon Kinetics' Inflation Beneficiaries ETF -- $INFL -- holds a number of stock exchanges in its portfolio: $ICE, the TMX Group, and the Deutsche Boerse).

2) Is there an argument to be made that the existence of BIVA is beneficial to BMV? Both exchanges list the same stocks. So theoretically, shouldn't arbitrageurs be driving up volume on both exchanges, as they arbitrage between the two?

Great writeup! Do the dividends flow properly to the unsponsored OTC listing?