Mexican Election Special: Everyone Please Calm Down & New Buy For Aggressive Portfolio

Sheinbaum's election win won't change the outlook for Mexican stocks.

Summary

Claudia Sheinbaum won the Mexican presidential election by a large margin, as expected.

Sheinbaum's victory was already priced into the markets, with analysts having offered positive views on her agenda prior to the election.

Mexico thrived economically under outgoing president AMLO, and Sheinbaum should continue his policies with a more technocratic approach.

Reports Monday that Sheinbaum had won a supermajority in the legislature were mistaken, markets are panicking without good cause.

Mexico had its presidential election on Sunday. As someone who has owned Mexican airport stocks for the past nine years now, I've been through numerous political panics including Trump election night (2016), the AMLO election scare (2018) and the AMLO is nationalizing the airports nonsense (2023). I figured -- apparently wrongly! -- that people were starting to realize that Mexico is a more stable jurisdiction and that we shouldn't have kneejerk double-digit sell-offs as frequently. And yet that's exactly what happened this past week, this time with even less actual reason for concern than usual.

I was tempted to write an angry screed on Monday but decided to wait until my emotions had cooled and I could take a more level-headed approach. Here you go.

---

The election results came in largely as expected with Claudia Sheinbaum, waltzing to an easy victory over her main opponent, Xóchitl Gálvez.

Anyone that had been paying attention to this election for more than the past week knew that Sheinbaum was going to win and win by a considerable margin.

Polling averages had her ahead by about 15-20 points and as I wrote in my preview of the election, the race was never competitive.

Polling on the race from 2022 up until election week.

Shocker, the candidate in red who had been way ahead the entire election cycle won easily. Quick, dump your stocks!

Even if things went incredibly right for the opposition, and there was a major tightening of the race at the end, the best Galvez could realistically have hoped for was to lose by single digits. There was never any plausible scenario where Sheinbaum would lose outright.

Almost every single reputable poll over the past year had Sheinbaum above 50% support. In a three-way race (a third candidate was also polling around 8%), a candidate over 50% isn't going to lose, end of story. Furthermore, markets had already made peace with Sheinbaum winning. In April she delivered a surprisingly pro-markets, pro-business agenda when discussing her policy framework at a meeting of economists. I recall reading several analyst and investment bank notes back in April which offered upbeat views on what the Sheinbaum administration will bring to Mexico.

By all accounts, long before election day, markets had already priced in that

1. Sheinbaum would win

2. At worst, she'd be more of the same as AMLO, if not a slight improvement

Specifically, Sheinbaum's pitch is that she'll carry on policy closely in-line with the outgoing AMLO administration. But, with a more softened edges and technocratic approach. That comes in contrast to AMLO's more 1980s style populist reactionary politics.

With Sheinbaum, Mexico appears to be going to get a more sophisticated European/Scandinavian style "democratic socialist" economic agenda. Many investors freak out when they hear the word socialist in any context. But as we have seen in much of Scandinavia and Western Europe in past decades, you can have a social democracy and relatively high levels of income redistribution within an economy while still having a modern economy with favorable investment returns and robust investor protections.

From her past education and career experience, her speeches, and her messaging, everything indicates that Sheinbaum is a professional and reasonable figure, not some bomb-slinging jungle-dwelling reactionary. In other words, think closer to Sweden than Hugo Chavez.

As a quick refresher, Mexico's outgoing president is Andres Manuel Lopez Obrador "AMLO" who was elected in 2018 on a left-wing populist agenda. Mexican stocks tanked on that election outcome before quickly rebounding when people figured out nothing too vital was going to change.

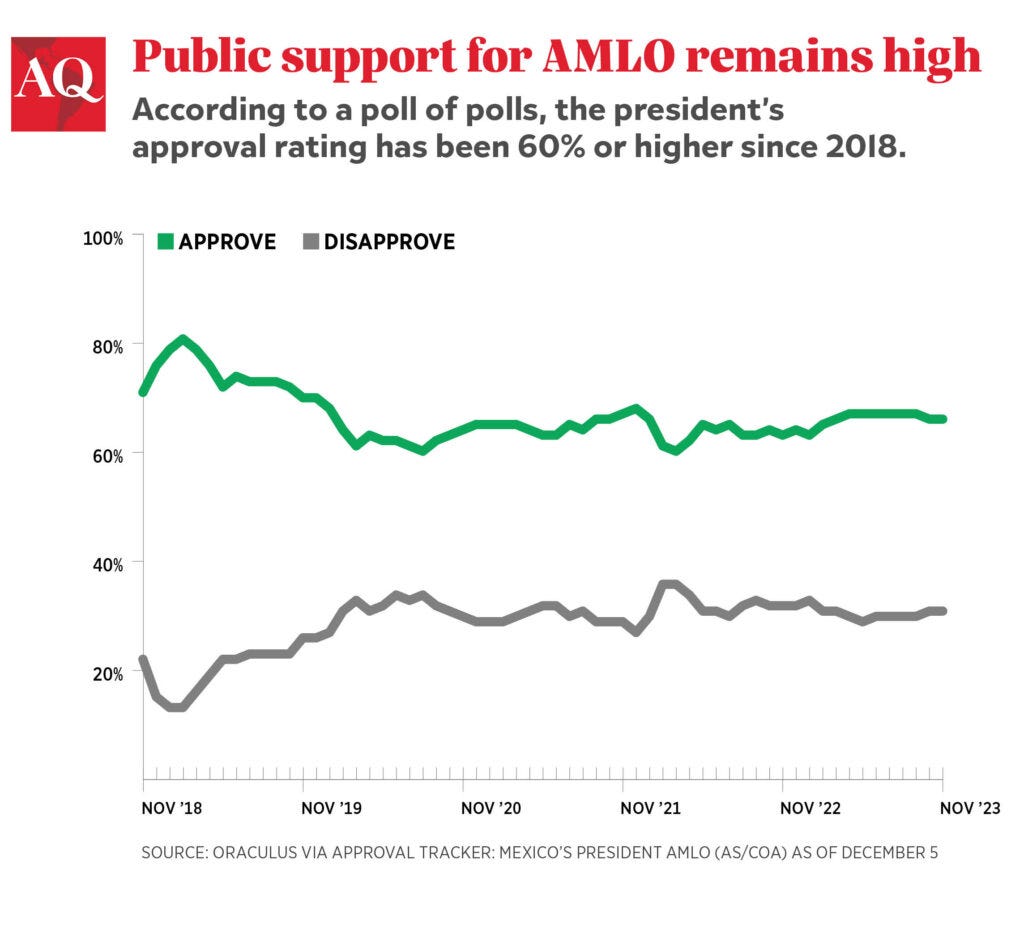

AMLO's time in office was highly successful, regardless of what Wall Street Journal editorials frequently claim. He will leave office as one of Latin America's most popular presidents with an approval rating generally in the mid to high 60s throughout his term.

Not only was AMLO highly popular, his approval rating was incredibly steady. AMLO handled all crises -- importantly including COVID-19 -- with ease.

As such, it was common sense that his handpicked successor was going to win an election easily as long as they promised to carry on AMLO's general policy approach.

As a reminder, Mexico was incredibly successful economically under AMLO.

Mexican stocks were the top performers in Latin America and one of the top three emerging markets overall under his leadership. The Mexican Peso has been the world’s strongest currency in recent years. And the list goes on.

Say what you want about AMLO's rambling speeches, sometimes anachronistic view of certain economic policies, and his questionable take on energy policy -- Mexico thrived under AMLO's approach.

You could argue that AMLO benefitted from favorable external events. China self-imploded during and following the COVID-19 outbreak, and somebody had to win all the new manufacturing business that has been fleeing from China. Similarly, Mexico was fortunate that most countries in Latam decided to put harsh COVID-19 travel restrictions in place, allowing AMLO's "do almost nothing" approach to COVID-19 to lead to a major Mexican tourism boom. (And as Mexican airport stock owners, we got paid thanks to this AMLO policy.)

More broadly, you could argue that Mexico was naturally going to benefit as the United States is focusing on bringing supply chains closer to home while seeking to reduce illegal immigration to the country. The United States has strong incentives for the Mexican economy to prosper, so theoretically any Mexican president could have had a favorable term during 2018-24 simply from these favorable external factors. (A decent parallel here could be Lulu in Brazil, whose first run was successful largely due to the Chinese economic boom; with China now in the dumps, Lula's second run as Brazil's president is going much worse than the first go-round).

All that said, AMLO certainly could have squandered the opportunity. After all, in 2018, his opponents were dredging up out of context quotes to claim he was a secret communist that was planning to turn Mexico into the next Cuba. If AMLO was half as bad as his critics had claimed, he would have been nationalizing assets, kicking out foreign companies, and turning Mexico into a peasant campesino state a la Bolivia, only with more palatable cuisine.

Instead, AMLO played his cards well. He built close ties with both former President Trump and President Biden, secured a key NAFTA deal renegotiation, attracted all sorts of new multinational firms to Mexico -- and in 2023 -- helped Mexico overtake China as the U.S.' #1 trading partner.

Mexico has also become so nice that it became ground zero for the remote work movement, with hundreds of thousands of Americans setting up shop in Mexico City and elsewhere to benefit from Mexico's lower prices, high quality of life, and improving security situation.

Was AMLO perfect for investors? Of course not. His meddling in the energy sector was terribly unproductive and strained the government's finances. The restrictions on mining are not helpful. And his frequent interference in the railroads, airports, and airline sectors directly caused me stress and anxiety, particularly during the Mexican airport stock crash of October 2023. I hardly see AMLO as a saint. But he deserves a lot of credit for operating a credible and successful left-wing government in a country that has historically been difficult to govern.

I know many in the investment community will reflexively cheer for all conservatives that win elections and dismissively reject all left wingers that come to power. I personally have a degree in economics and my financial policy preferences lean heavily in the libertarian direction. I quite enjoy watching, for example, Milei's unorthodox economic experiment in Argentina.

However, I realize voters are often going to select a left-of-center approach, and there is a huge range of potential outcomes from benign technocratic stuff at one end to Chavez at the other. Not all left-wing economic policies are created equal. Investors that can appreciate nuance will profit when the black-and-white thinkers panic-dump their stocks every time an election goes "the wrong way".

Back to AMLO specifically. On balance, he did well for his people, and he did well for the economy. Not only that, investors made a lot of money on Mexican stock and currency under his watch.

Mexican stocks under AMLO's rule versus relevant benchmarks. If Sheinbaum gives us six more years of this, sign me up.

As I discussed in my pre-election write-up, the general market consensus was that Sheinbaum would be a (modest) improvement to AMLO's policies. Since things were already going well under AMLO, there was no reason at all for panic when Sheinbaum inevitably won the election that was never remotely competitive in the first place.

Fast-forward to Sunday and suddenly traders forgot all context, saw some headlines, and started puking. The Mexican Peso immediately dropped as much as 8%, and Mexican stocks plunged as much as 12% (measured by the Mexico ETF EWW) on Monday.

If everyone knew Sheinbaum was going to win handily, why did the actual results cause such a different outcome?

The answer to that question is in the margin of victory. Sheinbaum ended up winning by 32 points whereas polls had suggested a win of 15-20 points. Though, I’d note, the 2nd place candidate did much worse and the 3rd place candidate did better than expected, Sheinbaum outperformed her own polling by about 7 points – still considerable but not quite as much of a shock as the headline figure would suggest.

In any case, before election day, the opposition had been increasing the polls, not nearly enough race to make it competitive, but the opposition appeared to be on the upswing. So perhaps people thought Sheinbaum might only win by 8-10 points and not have a huge political mandate. Instead, the opposite happened.

Regardless, AMLO was the most popular Mexican president in recent memory. He brought a lot of prosperity to the country, and ordinary peoples’ living conditions got materially better. Additionally, he had arguably among the best COVID-19 responses in the region. There was no reason for the average Mexican to be upset about his time in office. So, when he tells you to vote for this lady to carry on his legacy, most people are going to do it.

A foreigner might say voting for AMLO or Sheinbaum might not be Mexico’s best interest, and I could agree with you from an intellectual perspective.

But I’ve lived three years in Mexico. I was there under a conservative government that presided over a lousy economy and an explosion in the crime rate.

Meanwhile, the homicide rate fell every single year under AMLO’s watch and the economy got a lot better. I totally understand why the election went the way it did. Further to that, if Sheinbaum carries on the sort of policies and successes that AMLO achieved, I understand why Mexicans would be happy with Sheinbaum’s presidency as well. This is all makes sense, and it shouldn’t be that surprising that she won and with resounding numbers.

---

So what drove the equity selloff, then?

Due to Sheinbaum's larger than expected margin of victory, there was the possibility that her party (Morena) would win a legislative supermajority. In fact, many people on Twitter were posting -- as fact -- that her party had won a supermajority.

Once all the votes were counted her party did not in fact win a supermajority:

Monday's rumors and scaremongering turned out to be fake news. But Twitter being what it is, when something scary happens, people rush to hyperbolize and magnify the potential worst-case outcomes.

In addition, many people that know nothing about Mexico or the election rushed to judge Sheinbaum simply on her resume and physical characteristics. Namely, she's a woman, she's a Jew, and she was educated as a climate scientist, therefore she's supposedly some new world order conspiracy theory comic book villain come to life.

Say anything you want about her policies, her speeches and her potential effects on the Mexican economy. That's all fair game! But the idea that she’s inherently evil because of her gender, religious heritage, or educational background is the sort of biased political thinking that can cloud an investor's otherwise good judgment.

Getting back to the supermajority point. Her coalition won a large majority in the legislature, there's no disputing that. But let's use an analogy for the situation.

The U.S. equivalent would be if for example, the Democrats won the presidency, they won Congress, and they won 59 seats in the Senate.

As you may know, you need 60 seats to have a fillerbuster-proof majority in the Senate. With 60 seats, one party can push through any laws it wants without meaningful opposition from the minority party. 60 seats in the Senate (plus control of the house and presidency) gives a tremendous amount of control over the American political system.

This outcome has happened on several occasions, and yet the U.S. hasn't yet devolved into either a communist worker's paradise or a far-right conservative fever dream.

Most recently, President Obama had a supermajority in the Senate for two years of his term. And yet Obama passed far fewer revolutionary policy reforms than his supporters had hoped or his opponents had feared. A democratic country doesn't necessarily tip into total anarchy the moment one party wins complete legislative control (there are many examples in Europe I could point to for this as well).

In this case Sheinbaum did not even get a supermajority to start with. Again, that was fake news being reported on Monday. Sheinbaum has a strong political mandate -- at least to start her term -- but she doesn't have absolute power. And for what it's worth, Sheinbaum campaigned on being slightly more to the center and pro-business than AMLO was.

I'd imagine the last major concern/talking point will be that AMLO is pursuing some structural changes before he leaves office, such as the popular election of Mexican supreme court justices. This was already in progress before the presidential election occurred, but expect the media to try to tie the two events together to paint some broader negative. (Indeed, Mexican stocks fell again on Friday on these worries).

Regardless of the headlines, however, there's little concrete reason to believe the Sheinbaum presidency will dramatically change Mexico's democracy or economic system.

Remember, at the core of it, AMLO led a rapidly-growing economy with a growing middle class, falling violent crime, and a highly effective response to COVID-19. Sheinbaum has more educated and technocratic tendencies than AMLO did, and it seems unlikely that she'd want to pivot from effective governance into some sort of unhinged strident leftism and tank her own popularity and mandate while doing so. Anything is possible, but the odds of it are fairly low. I'd also note she has much less charisma than AMLO, so I'd imagine her popularity will fall over time simply from not being such an idealized figure as AMLO was.

I'm open to changing my mind if new evidence presents itself, but so far nothing about Sheinbaum's campaign suggests that we need to be particularly worried at this point.

Adding A Mexican Position To The Aggressive Portfolio & Thoughts On Existing Holdings

With that macro overview set, let's dive into individual Mexican stocks and sectors, starting with…

Airports

Some of the most irritating discussion around Mexican stocks this week was with the airports. People on social media are suggesting that Sheinbaum is going to bring down the hammer on the airport stocks in particular, pointing to -- among other things -- her educational background in environmental science as proof that she has it out for aviation or something.

To which I'd say to those people: "Is this the first week you've ever looked at Mexican airport stocks?"

For those of us who have invested in this sector over the long-term, there has been no shortage of sudden 20-30% sell-offs (sometimes more).

For just four examples, the airports dropped 30% on Trump winning in 2016. What would Trump do to hurt Mexican airport profits? Absolutely nothing.

I named Pacifico Airports (NYSE:PAC) my top stock pick of 2017 and shares rallied 50% within six months.

In late 2018, the airports tanked again, this time due to AMLO winning the presidency and taking office in Mexico.

AMLO started off his administration, you may recall, with a massive disruption to Mexican aviation. He cancelled the already half-built new Mexico City International Airport, causing more than $5 billion in losses. Ultimately, the Mexican federal government ended up paying off the bondholders that funded the airport in full; private investors didn't lose a single peso.

Counterintuitively, this was also a huge win for the private airport operators -- by kneecapping Mexico City's airport capacity, AMLO's move forced airlines to focus their new routes at cities like Guadalajara (Pacifico Airports) and Monterrey (Centro Norte Airports) rather than the capital city.

But, as would become a recurring theme, foreign investors only read the initial headline -- AMLO STUPIDLY CANCELS HALF-BUILT AIRPORT, LEAVES BONDHOLDERS HOLDING THE BAG -- and feared the worst. It was left to people like me to explain the actual realities and economic consequences with nuance, but of course, that sort of nuance doesn't tend to resonant within the social media/Twitter information ecosystem.

Let's turn to COVID-19, how did the airports handle that?

Keep reading with a 7-day free trial

Subscribe to Ian’s Insider Corner to keep reading this post and get 7 days of free access to the full post archives.