LatAm 2025 Investment Outlook: My Predictions For The Region's Six Big Countries

Can Milei keep winning? Elections in Chile & much more...

Summary

How long can Argentina's party keep going? A measured look at Milei's economic agenda one year in.

Bullish on Chile, Colombia, and Mexico for 2025. Elections offer particularly good catalysts for the first two.

Explaining why Mexico and Brazil offered equally dour returns in 2024 even though one has strong prospects going forward and the other does not.

Not too upbeat on Peru, also quick thoughts on Venezuela and Ecuador

To start off 2025, it's time for a high-level post reviewing the outlook for various Latin American countries and investments this year.

I’ll go country by country through the six widely investable Latin American markets, in other words the ones with ETFs, and then a few quick comments on several other smaller countries.

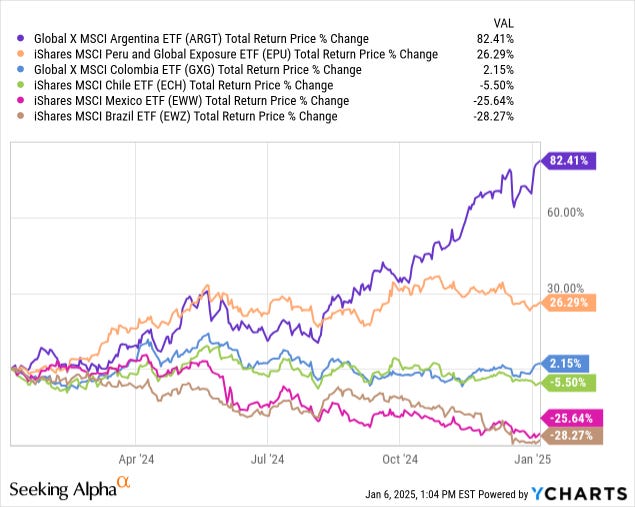

Let's go through them starting from the top performers last year down to the laggards.

Argentina: How Long To Ride Milei's Hot Hand?

So, to start out with Argentina. Argentina was up 82% over the past year, extending its total gains to 250% over the past five years. Argentine equities are sitting at a fresh all-time high on the day I'm editing this.

I’ve discussed Argentina extensively over the years. And our position in Corporation America Airports (NYSE:CAAP) became the first ever 10-bagger holding within the aggressive portfolio. So, Argentina has been good to us around here.

What's new for 2025? The question will be if Javier Milei's reform agenda continues to gain more momentum or if he starts to run up against organized pushback against his radical overhaul agenda.

Six months ago, I would've said I was a bit nervous because the Argentina economy did slow down sharply in 2024 (GDP will finish the year down about 4%, though it returned to positive growth in Q4.) This wasn't a bad result, all things considered, given that he slashed the government's spending so dramatically that it allowed the Argentine government to run its first annual surplus in more than a century. He also stabilized the Argentine peso.

Milei is trying to impose shock capitalism on an economy that is weighed down from eight decades of socialist failures. The last countries to escape such a long-term centrally-planned economic quagmire were the Eastern European ones such as Poland and Slovakia as they exited the Soviet Union in the 1990s. Needless to say, Milei is facing a tall order here, though his mix of charisma and ruthless decision-making has given him at least a moderate chance of achieving long-term success in the country.

Milei faces midterm elections at the end of 2025. As mentioned, the economy was shrinking fairly painfully for most of 2024 and the overall poverty rate surged more than 10% this year. The pain is particularly hard-hit in Buenos Aires, where much of the population historically lived off of government handouts and is having to adjust to the new capitalist ethos.

Argentina's economy badly wobbled in the first half of 2024, but appears to be on an upswing quickly enough to give Milei momentum heading into midterm congressional elections toward the end of 2025. Is Milei is out of the woods? Not yet. A ton of Argentinians were used to relying on handouts and freebies for things like healthcare and education. It remains to be seen how much voters will punish Milei for taking away the handouts.

A lot will likely depend on how quickly he can reactivate the economy outside of Buenos Aires. That is to say, can he generate enough growth from sectors like mining, energy, agriculture and forestry in the more rural provinces to create dramatic jobs and prosperity in those areas. If he can run up huge electoral margins in the countryside (as he did in the 2023 election, this probably would be enough to offset increasing backlash from more socialist-minded voters in Buenos Aires).

When I was traveling through the Argentine countryside years ago under the Kirchner government, it was amazing how much land was simply lying fallow. Farmers didn't think they could make money at the government's highly artificial exchange rate if they planted crops, so the land just sat there doing nothing. Now, farmers can make good money selling their cops at a more proper exchange rate, and the government is not impeding their ability to do business.

But will owners of these real assets like farmland invest in them and bring them (back) up to globally competitive standards? If people get the sense that Milei is just a brief aberration from the status quo, there won't be enough investment in capital assets to bring the economy to a sustainably healthier footing. It will takes many years of market reforms to make urban Buenos Aires' economy more globally competitive, but if Milei can get quick wins in the basic materials sectors, that might give him enough with voters to carry out the hard work of making the country's most economically complex sectors viable as well.

Long story short, I'm still not confident Milei will ultimately be successful. But I previously gave a one-in-three chance that he would win the election back in 2022 when no one had heard of him in English-speaking world. That was enough of an EV+ bet that we cashed in big when his unlikely but hardly impossible candidacy ultimately made it over the finish line. And when he took office, I figured he had a less than 50% chance of ultimately succeeding, but that he had the charisma and decisiveness to at least have a real shot at it. So far, I'd say his 2024 was reasonably positive -- better than we would have guessed on average when he took office.

That said, the market is now assigning much more reasonable odds to Milei's mission.

Specifically, some Argy stocks, like TGS, are now up 10x from where they were in 2015 (just prior to when the last conservative Argentine government was elected in Dec. 2015.):

As a reminder, Mauricio Macri came to office on a traditional right-wing platform in 2016 but rolled out a series of half-hearted measures that failed to make steep structural changes to the economy. I turned very negative on Argentine stocks in 2017, calling out bank shorts there as a top idea. While Macri did alright in midterm elections in late 2017, things rolled over in 2018 ending in yet another inflationary spike and IMF bailout.

Macri's reform movement never aimed high enough to have achieved the tough changes the country needed. And he was further scuttled by weak commodity prices, unfavorable weather, and other such factors, which helped speed up the collapse of his reform movement in 2018, roughly 27 months into his term.

With Milei, we're 12 months into his term, and he has way more momentum (and popular support) than Macri did. It's possible to imagine a world where Milei gets reelected in 2027 and he has enough latitude to truly cement a new path forward for Argentina. By contrast, Macri was already starting to sputter at this point in his term.

So it's quite reasonable that Argentine stocks are around peak-of-the-past-cycle prices, as the political/economic situation is significantly better than last time investors bid up Argentina on conservative government hopes. That said, if Milei loses his touch and it becomes clear that his measures aren't going to stick, Argentine stocks would crash again, just as they did in 2018.

I can't overstate the level of historical volatility in Argentina, just consider shares of its long-running bank GGAL:

Shares went from $20 to $0.50 in the early 2000s when Argentina defaulted on its debt. GGAL's equity survived and quickly returned to $10. Shares lost most of their value in 2008 before going up 10x coming out of that. After a small (by Argentina standards) selloff in 2012, shares would gear up for their next 10x run until the wheels unceremoniously fell off the Macri government. The stock proceeded to drop 90% through the COVID lows before going up 10x again with the rise of Milei.

Could GGAL go up another 5 or 10x from here? Argentine stocks always overshoot fair value in both directions. And the bank has become significantly more profitable over the years (albeit with volatility) and so the share price should be able to hit higher highs in the future:

That said, you won't see me pounding the table to stay long most individual Argentine names, even though Milei is doing better than expected... I'm not sure being moderately ahead of expectations has materially changed the underlying value of stocks like GGAL or YPF enough to fully reflect that.

YPF, for example, was trading at $3 not that long ago and now it's at $45. Is the value of a state-run oil company really 15x higher than it was three years ago? Maybe. But probably not. I'd rather bet on the value of a state-run company trading near the lows (such as Ecopetrol NYSE:EC) rather than chasing one already up 1,500%.

That's not to take anything away from Milei. But I fear that many foreign investors are getting the idea that Argentina has already become some hyperlibertarian Ayn Rand utopia, whereas it's still a country with a 53% poverty rate, a soaring unemployment rate, and one where 40% of young Argentines live with their parents because they can't afford housing.

That is to say if Milei loses steam with his reform agenda, voters could easily lose their will for an austerity agenda. Milei is on the right track, but significant challenges remain for the current capitalist moment in Argentina to become a more permanent development.

---

The bullish caveat here is that I continue to pound the table for Corporacion America Airports (NYSE:CAAP). There, the business quality is sharply higher now than in 2018, the P/E and EV/EBITDA ratios are much lower than in 2018 and yet the stock price is only marginally above the 2018 IPO price.

And now, with the aircraft engines issue being fixed along with swift privatization/liberalization of the Argentine airline sector, there should be a sharp upturn in traffic from increased demand as well. CAAP is trading at 10x forward earnings and analysts are forecasting 17% revenue growth this year. That's a bargain, regardless of what we think about Argentine politics.

Peru: I Don't Get The Optimism

Turning to our number two ETF for the region, surprisingly enough that was Peru with a 26% gain over the past 12 months. Peru's market success stands out given its challenging political picture.

Specifically, Peru has had six presidents since 2016, despite having only two presidential elections during that time (tip of the hat to Manuel Merino, who was president for five days. May his legacy never be forgotten):

The current president, Dina Boluarte, has had her approval rating hit as low as 4% in recent months, making her one of the least popular presidents in world history. I would imagine even someone like Stalin could get a 4% approval rating -- it's hard to generate such unified hatred.

Boluarte came to this position by being the VP for Pedro Castillo, the self-avowed Communist peasant who became president in 2021 (yes, you read that correctly). Boluarte, despite ostensibly being a far-left candidate, pivoted to the right once Castillo was detained for corruption charges. Boluarte's transformation from Marxist VP to law-and-order businesswoman was seemingly the perfect way to offend absolutely everyone, leading to her rock bottom approval rating.

And yet, Peru's economy keeps ticking along, as a collection of wealthy Peruvian families have ignored the political drama and managed to keep society going.

How long can a country keep impeaching and/or arresting its presidents every year or two and having both a congress and president that no one in the country approves of whatsoever? It's a good question to which we don't have an answer.

I will say I traveled around Peru (both in Lima and the mountains) in 2024 and things looked a lot poorer and more run down than they were pre-pandemic. Peru increasingly looks like a whole lot of Bolivia attached to a few wealthy neighborhoods in Lima -- as opposed to being a broadly developing middle-income country. And that pains me to say, as I've been a big booster for Peruvian travel and tourism in the past, but it's clearly on a troublesome trajectory at the moment.

Why were Peruvian stocks up in 2024 then?

Copper did finish 2024 up a bit year-over-year, even after it faded sharply in the back half of the year.

Given how much of Peru's economy is tied to exporting copper along with gold and silver (also seeing good pricing lately), Peru was able to cobble together positive economic growth in 2024 even with a completely nonfunctional government.

That said, economic growth only driven by mining is not likely to be a sustainable model as long as the government is broken. The country has a huge indigenous population, and one that already voted for a self-avowed communist in 2021. With income inequality continuing to rise, don't color me surprised if they vote for another wacky candidate in 2026. When the current incumbent has a 4% approval rating, anything can happen. If the indigenous populations stop believing that the country's economic model will ever deliver results for them, you tend to start getting permanently broken political systems (a la Bolivia or Guatemala) that don't lead to good outcomes for investors or society at large. I hope Peru can still turn things around, but my last visit to the country left me surprisingly worried for its long-term trajectory.

Can Peru surprise in 2025 with another winning year? What's your view on China and copper demand? I've already expressed my skepticism of the Chinese stimulus efforts, and I cut my exposure to Chinese stocks when they rallied in the fall. And that was even before Trump was elected; I see a major U.S.-Sino economic war brewing if things remain on their current trajectory.

You can make the case that Peru is still a value and that its companies are attractive. Credicorp (NYSE:BAP), for example, is at 10x earnings and a 5% dividend yield for a dominant bank that also operates Peru's leading FinTech app with massive growth. Can I make a case for BAP stock this year? Sure. Is it the best opportunity within the LatAm financials set in 2025? I doubt it.

Colombia: Setting Up Huge Returns With The 2026 Election

For example, we can buy even cheaper stocks in last year's #3 performing market, Colombia. Colombia got to slightly positive territory for the year, trailing Peru but closing well ahead of Chile and miles ahead of Mexico and Brazil.

And the set-up for Colombia is much better than Peru going forward.

Colombia has elections coming up in spring 2026 and the right-wing is highly likely to win. The current left-wing president, Gustavo Petro, has a roughly 25% approval rating and he's also term limited. His vice president is not popular and has minimal political capital. This means that the current left-wing government has failed and has no clear replacement candidate to try to carry on their mandate.

So, unless something radically changes, the only question is whether Colombia returns to a center-right president (our usual status quo in our modern constitution era) or if some far-right Bukele style candidate emerges. We're still early in the sorting process for trying to figure out who the candidates will be. However, polling shows conservatives doing well generally, meaning that the eventual outcome is easily forecastable, if not the exact magnitude of the swing back to the right remains to be determined.

Something like Ecopetrol (NYSE:EC) at 4.5x earnings and 3.5x EV/EBITDA into a sharply improved government/regulatory environment seems rather nice. Especially when you consider that they control 100% of the refining capacity in Colombia along with sizable holdings in toll roads, pipelines, power lines, and power generation capacity -- it's not just a bet on pureplay oil and gas production. Like I said earlier, would we rather chase YPF, Argentina's state oil company, after it is already up 1,500%, or buy something like Ecopetrol while no one has discovered the new pro-business government yet?

Similarly, Bancolombia (NYSE:CIB) is selling at sub-6x earnings and is paying a 10% dividend yield. And earnings have been up recently, the bank is actually performing well despite the negative sentiment around Colombia and our government. It's hard to see much downside ahead of elections where conservatives are overwhelmingly likely to win.

Put another way, I believe Colombian stocks could triple with the pending election cycle, and the date of those elections (May 2026) is drawing ever-closer.

For what it's worth, with the Colombian Peso and its currently depressed exchange rate, the country is also the best value for travelers wanting to visit a large Latin American country this year (Peru being the only other competitor around that same bang for the buck at the moment) so for anyone wanting to do some sightseeing and on-the-ground diligence on their investments, this could be a good year to visit.

Chile: More Good Than Bad In 2025

Keep reading with a 7-day free trial

Subscribe to Ian’s Insider Corner to keep reading this post and get 7 days of free access to the full post archives.