Crypto Is Collapsing: Takeaways From Another Financial Bubble Gone Poof

What we (re)learned from the collapse of the crypto and ARKK/SaaS bubbles.

A lot of people had been pointing to a lack of capitulation in the financial market's worst absolute lowest-quality assets as a sign why the bear market must persist.

Two things. First, Bitcoin is down 20% in recent days after the collapse and apparent insolvency on FTX. FTX, you may recall, was the crypto exchange whose founder, Sam Bankman-Friedman, went on a Bloomberg podcast and literally described crypto lending programs as a ponzi scheme. In any case, said founder seemingly wasn't savy enough to cash out at the top, according to media reports, he lost 94% of his net worth Tuesday, dropping from over $10 billion to less than $1 billion in a single day. He is now in the Bahamas and is deemed a flight risk.

Bitcoin, meanwhile, is finally well under the $20,000 mark and most other smaller coins like Solana, Cardano, and Dogecoin have imploded. Solana, for example, was down 40% in one day last week.

You might expect me to take a victory lap on my avoid crypto calls. But it brings me little pleasure to be right here.

A bubble like crypto gives its skeptics nothing but trouble. When the bubble is inflating, people call us skeptics old-fashioned, ignorant, or behind-the-times. We missed the next big thing. We just don't get it. Have fun staying poor.

And then when it inevitably crashes, there's little to be gained from that either. It's in poor taste to dance on anyone else's financial grave. And, with the benefit of hindsight, everyone says they saw the bubble coming; few people notice or care who actually called out the bubble before it popped.

I guess it's a win for my predictive abilities to see all of crypto implode like this, but c'mon, it was obvious. I get no brilliance points for pointing this mess out before it imploded.

Crypto has no utility, produces no profit or cash flow, and the people that were running the major companies aren't skilled at basic financial things such as risk management, statistics, or accounting.

There was no great mastermind running the fraud at FTX. Rather, there was an incredible lack of curiosity and common sense from the VC folks and celebrities that made the likes of FTX, Celsius, Tether, Terra/Luna, and other blatant ponzi schemes possible.

Instead of ranting, I'll simply reiterate my recommendation to read books of financial history. Virtually everything that people lost spectacular amounts of money on in 2022 has happened in the not too distant past. The 2020-1 SaaS/SPAC bubble was a virtual replica of 1998-2000 dot-bombs. The FAANG mania of 2016-21 was a carbon copy of the Nifty Fifty in the early 1970s. And now their unwindings are playing out similarly, with inflation being the proximate cause of both bubbles' end.

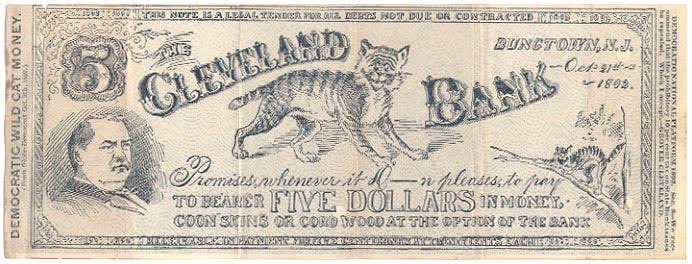

Meanwhile, crypto was an almost perfect reenactment of the U.S. wildcat banking era in the early 1800s. In that time period, there was no central bank of the U.S. and so local banks were responsible for issuing their own money.

There, each town or local region had its own currencies, issued by its banks, which were supposed to be exchangeable for U.S. Dollars. These local bank scripts often failed when there was a crisis of confidence. Given the lack of a Federal Reserve or other central stabilizing entity, this system was incredibly fragile.

Substitute local banks for cryptoexchanges, and you have the exact same thing with Celsius, Tether, FTX, Binance, etc now. Crypto is a bunch of unregulated and unscrutinized entities that have nothing more than the confidence of the public to support their tokens. When that fails, formerly multi-billion dollar businesses like FTX go bankrupt literally overnight. Now people that lost money on crypto are begging government regulators to do something -- anything -- to get their money back.

That's the exact same pattern of getting burned and subsequently demanding government action that led to America's current system of central banking and FDIC and SIPC protection that we have today. If crypto leaders had read an economic history book instead of simply "innovating," they could have saved themselves a great deal of stress and financial loss. But human nature being what it is, we're doomed to keep repeating the same mistakes over and over.

You the reader, however, can avoid most of these pitfalls by being well-aware of history and seeing when we're repeating a tried and failed idea.

Predicting the future can be difficult. However, it is not hard to study the past, see how other people have failed, and learn from their mistakes. I have an encyclopedic knowledge of financial history and, if nothing else, it at least enables me to share with you what not to do, especially during manias and panics.

---

Wrapping up, crypto was a sad but predictable rerun of the human desire to create wealth out of nothing. The techno-babble around decentralized money and science fiction utopias allows folks like Sam Bankman-Fried to put a new varnish on tried-and-failed wildcat banking, spinning it a new technocratic altruism gloss.

However, lots of utopias are proposed and fail to take off whatsoever.

Crypto was more successful than most since it played into a lot of popular narratives. People were made at the banks after the 2008 financial crisis, and were willing to support any alternative -- no matter how inadequate -- to "punish" the banks.

Celebrities were willing to promote crypto. A new generation of people have now learned that Matt Damon and Tom Brady may be great actors and football players, but that offers them no special insight into investing.

And finally, the promoters were able to push a popular narrative -- inflation and the debasement of fiat money -- to sell folks literally worthless alternatives. How exactly was a Dogecoin or a .jpg rendering of a rock going to protect an investor from inflation? But, during a hysteria, people are highly amenable to going for any solution -- no matter how bizarre -- as a seeming antidote to the problem at hand.

The best vaccine against this sort of wishful thinking is to be well aware of history. To a financial historian, the idea of bringing back wildcat banking a la crypto was about as enticing as bringing back leeches and bloodletting as a form of medicine. But for people that didn't know the past, they were susceptible to repeating it.

---

If nothing else, when considering a new investment idea, ask yourself "Has this has been tried before?" And, if so, did it work out previously?

This is why a legitimately new industry is interesting. I can see a market for space & satellite companies, automated factories, and gene-editing biotechnology, to give three examples. These all unlock new technologies and abilities for humankind.

Something like FinTech, however, is usually just grifters repackaging a combination of subprime lending and regulatory arbitrage as something new. They achieve the con by using a magic belief-suspension device "our proprietary algo" or "machine learning" or whatever to fool the investors. Lending is the oldest industry known to humankind; a few engineers in Silicon Valley aren't going to crack a secret code here. Similarly for cryptocurrency and replacing actual money with hastily-crafted computer tokens.

For another, consider Opendoor and Zillow, which tried to "reinvent" housing with a (surprise surprise) magic algorithm to buy and sell homes more efficiently than humans. Zillow exited the business in 2021 after taking losses. Opendoor stock, meanwhile, is down more than 90% this year after overpaying to buy tons of houses in Las Vegas, Phoenix, and other sunbelt markets which have subsequently collapsed.

Opendoor investor and backer Keith Rabois claimed last year that he was the single smartest real estate investor in America. Now his Opendoor is suffering massive operating losses, layoffs, and may end up facing bankruptcy reorganization in the next few years. What went wrong? Opendoor's founders, either through utter hubris or financial shenanigans, presented a magic formula that would replace all of accumulated human knowledge of how the housing market works with a computer black box.

Was there any evidence it worked? No. Opendoor always lost money. But Enron never proved its off-balance sheet investments made money, nor did Theranos ever demonstrate that its blood tests had any functionality either. People will believe in anything if the story sounds good enough and they aren't sufficiently trained or informed to evaluate the narrative on its actual merits.

An avid reader of history knows about the failure of the Miami real estate bubble in the 1920s, the Texas bust in the early 80s and subsequent savings and loans failures at the end of that decade. And then there was 2008. You simply aren't going to fall for Zillow or Opendoor's marketing gimmicks if you've seen past real estate companies use the same language to fool folks in a previous cycle.

Reading history may be boring, but it's incredibly valuable. That's especially true in a world where 90% of our investing competition gets all their information from CNBC, Twitter, LinkedIn and other ephemeral sources. Very few people -- even seemingly serious investors -- have any cogent understanding of the world beyond soundbites nowadays, giving those of us that do any work a tremendous advantage.

---

Knowing what not to invest in isn't a silver bullet. Accurately predicting which companies will be 10-baggers as opposed to merely treading water is still a difficult art. I don't have all the answers, far from it.

But avoiding scams, frauds, and mass hysterias is an invaluable skill. You will earn tremendous returns over your lifetime making 10-12%/year compounded let alone 15% as long as you avoid huge downside risk. As long as you keep losers small, the gains add up without too much trouble. 12%/year doubles your money in six years. That's five doubles over a 30-year span. $300,000 invested turns into $9.6 million. The path to a very wealthy retirement is actually fairly simple; invest a decent sum every year and avoid big losses. Compounding solves the rest.

Unfortunately, many people bet big on crypto, 25x revenue tech stocks, SPACs, and other get-rich-quick-schemes and are now trying to climb out of a 50%, 75%, or even greater hole. That's a devastating place to be. They have to make 300% to get back to even after losing 75%, for example.

But even worse than that is the psychological damage of taking a huge loss. People lose their ability to calculate risk, make level-headed decisions, and keep focused on long-term goals and opportunities. Many people that lost big in crypto, ARKK, and whatnot will exit investing altogether and fail to reach their retirement goals.

And, sadly, this won't be the end. While the 2021 tech bubble is popped and crypto, let's hope, is gone from the mainstream, humanity hasn't changed. Most people will forget the lessons of these busts in due time. And a new younger generation will come along that weren't adults yet when this current round of bubbles popped.

I'm sure I'll be writing to you about some new frenzy in a few years and people will be leaving the usual comments saying "Ian doesn't get it" and "Ian is too old to understand."

Bubbles, like everything else, are a cycle endemic to the human experience. They can be frustrating as investors, since they are all everyone talks about on the way up, and then it's just depressing to think about all the wasted human capital and wreckage once they've imploded. But, dealing with bubbles is part of investing. Comes with the territory.

And, on the plus side, when everyone piles into one asset class, such as technology and crypto in 2020, it creates tremendous opportunities elsewhere. Our aggressive portfolio has been highly successful since inception, in large part, precisely because we bought energy right at the height of the tech bubble, when they were just giving away those old fossil fuel companies for 2-3x today's earnings.

It seems like just yesterday that ARKK was trading over $100/share and Cathie Wood issued a $12 price target for oil. Now oil is worth $100 and ARKK will soon be trading at $12.

Financial markets misbehave at times, but capital ends up being redistributed fairly quickly from the pretenders to the real investors. That's my view on financial folly anyway.

I take little pleasure in watching retail investors lose in crypto, ARKK or whatnot, though I would be happy if guys like Sam Bankman-Fried that committed fraud do go to jail. But ultimately, financial schemes that don't produce profits will fail and their misallocated capital will eventually make it back to investors like us that buy real business with strong profits at good prices. Capitalism is very good at getting money to its rightful owners, as long as you have some patience.

This is a brief excerpt from last Weekend’s Digest, #228. A pro subscription gets you all my latest investing ideas and commentary.