Argentina: Milei Wins, The Road Ahead, And CAAP Update

Navigating the new era for Argentine investments

Milei Wins

Javier Milei is the president-elect in Argentina. Not only did he win, he won by an 11% margin. This is simply wild. Polls had the race as too close to call; if Milei won, we would have expected it to be by a whisker. Instead, he has won a decisive mandate to impose shock therapy capitalism on Argentina.

It's hard to overstate how extreme Milei is. A short list of his policy agenda includes:

Shut down the Argentine Central Bank

Replace the Argentine Peso with U.S. Dollars

Fire 80% of the government's employees

Privatize almost all of the government's businesses (oil & gas, telecoms, transportation, media, etc.)

Cancel alliances and planned alliances with left-wing countries and pivot to the U.S. as Argentina's key economic partner.

Milei is a self-avowed anarcho-capitalist (think Ayn Rand school of thought). To give one example of his eccentricity, he claims to communicate with his cloned dogs, that he named after libertarian economists, which give him advice. The man has some peculiar beliefs and personal views.

That said, when he stays on-message, he has charisma and can deliver a compelling speech. Here's a recent example of him laying out his agenda with English subtitles that gets his message across nicely.

I've seen people saying his government will fail to get much done because the last batch of conservative Argentine politicians (Macri and friends) failed in 2015. But this would be the equivalent of saying that because George Bush failed to deliver on his conservative economic agenda in 2000 that a Ron Paul presidency would make no impact on the financial markets. You simply can't compare a center-right traditionalist with the most extreme libertarian to win public office worldwide in decades.

The closest comparisons that one could reasonably latch onto are probably Bukele in El Salvador or Pinochet in Chile. That is the sort of economic agenda being proposed, and one which would be highly favorable for investors.

The difference being that both Bukele and Pinochet acted as authoritarians and used state violence to enforce their will, whereas Milei will presumably have to operate within the constraints of a democracy that honors human rights. That said, Milei is aiming to burn as much of the Argentine institutional system and government to the ground as possible -- this is not just another conservative government.

Will Milei's policies work? Who knows. Today is not the time for that debate.

What is certain, however, is that Milei will be one of the most chaotic forces we've seen in a prominent emerging market in decades. He is the most eccentric far-right economist to win office of a major country since I've been alive.

At the end of the day, investors like deregulation, tax cuts, and free markets. Milei is about to unleash the largest deregulating, tax cutting, and free marketing campaign since Poland/Slovakia/Czech Republic went capitalist in the early 1990s. Whether or not Argentina ultimately succeeds, investors will appreciate the effort for a good while we wait to see how it fares.

A Mandate For Shock Capitalism

It would have been one thing if Milei won a nailbiter election over a deeply unpopular socialist figure. Polls had the race as a tie going into election day, and if Milei won 51-49, it wouldn't be that monumental. But Milei absolutely crushed Massa in almost all of the country.

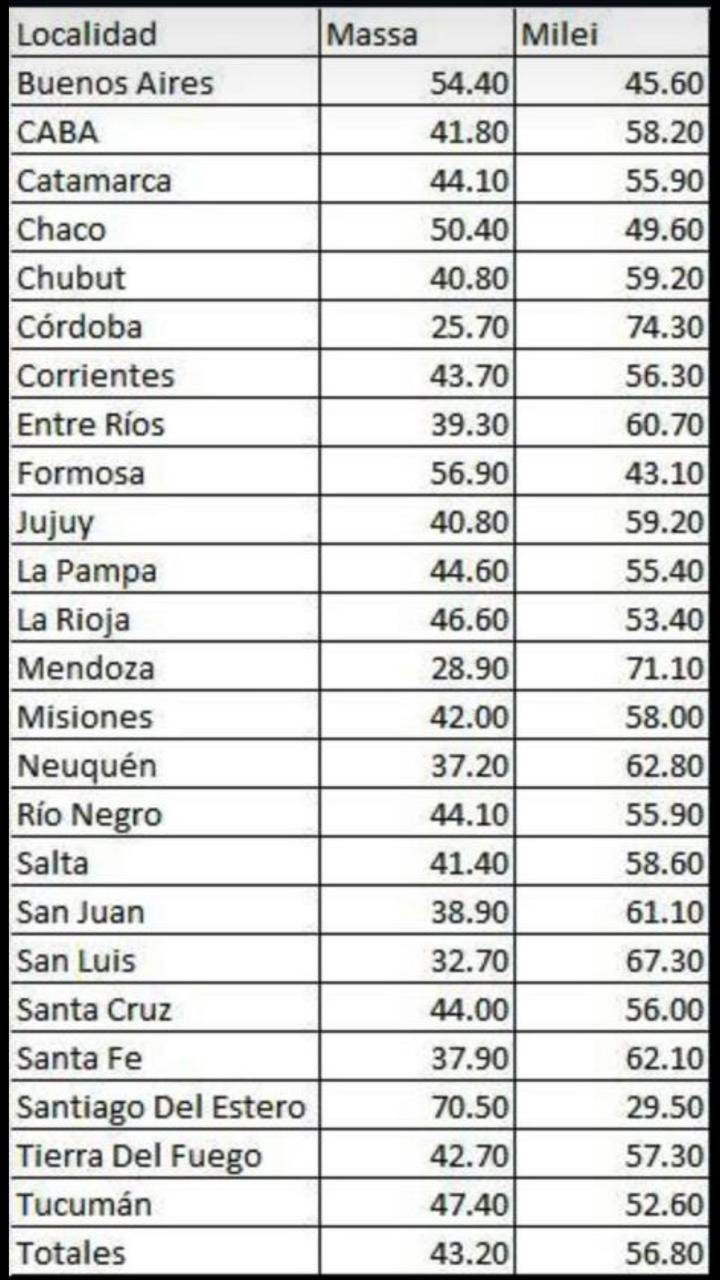

Below is a table with the vote margin by Argentine province:

I highlight this since you can see Massa won only 4 provinces, while Milei won almost everything aside from the city of Buenos Aires. Importantly, Milei won breathtaking amounts in Mendoza (71%) and Cordoba (74%) which are the most important economic regions in the country aside from Buenos Aires.

What's going on here? The government subsidizes and employs a massive number of people in Buenos Aires. Out in the countryside, the federal government does very little for those folks.

Buenos Aires' metro area constitutes a full third of the entire country, however, meaning that the city wields outsized power.

Milei, however, was able to lose Buenos Aires by a relatively small margin (54-46) while running up gargantuan vote totals in the provinces that rely on farming, ranching, mining, and other such industrial activities.

It's crucial to understand how the system works in Argentina. The socialist government has made natural resources nearly impossible to profit from by manipulating the exchange rate.

When you produce soybeans, for example, you have to sell at a false exchange rate imposed by the central government. The government uses the money taken from industrial enterprises to fund its vast social programs in Buenos Aires. If you're wondering why an agricultural firm like Cresud has produced zero total return over the past 20 years, that's why.

The year I was traveling around Argentina (2014-5), we drove by much farmland that was simply lying dormant. Farmers didn't bother to plant given that the fake exchange rate was so punitive that they would have lost money even trying to grow anything.

In one fell swoop, Milei will blow up this whole fictional exchange rate/capital controls game and let all the miners, ranchers, farmers, etc. sell directly to the U.S. and its friends for dollars. It's impossible to overstate how much this will do to unlock productivity in the rural provinces of Argentina.

If you read the work of geopolitical analysts like Peter Zeihan, it's evident that Argentina should be one of the world's wealthiest countries, given its incredible natural resources, favorable geography, and coherent culture and national identity. Due to Argentina's horrifically counterproductive economic policies, however, it went from being one of the world's top 10 economies a century ago to a poor nation now.

Can four years of Milei make Argentina prosperous again? Probably not. It took a lot more than four years of radical conservative economics to turn neighboring Chile around in the 1970s and 80s. But can Milei make enough progress unlocking the potential of Argentina's wildly underutilized natural resources to get re-elected? Quite possibly. The competition, after all, is the socialists who presided over 140% annual inflation and the utter destruction of the Argentine Peso. Milei has a low bar to clear.

Milei has a complicated road ahead and his presidency could easily get derailed. But the foreign business media is being much too quick to write him off entirely.

Abolishing The Peso -- Near-Term Investment Effects

Argentine shares had a huge gap up on Monday and have largely traded sideways since then. There are several technical factors at work that complicate the short-term outlook even though the 2024 outlook is strongly bullish.

For one thing, the country of Argentina was on national holiday Monday, and then the U.S. market is effectively shut down from Wednesday-on for Thanksgiving. In effect, we had only one day this week with reasonable liquidity in both markets (Tuesday). We should have a more accurate assessment of market sentiment next week once both markets are open at the same time with regular trading volumes and bank trading desks providing normal liquidity.

This is of particular importance since cross-border arbitrage is a huge driver of capital flows for Argentine equities. This is due to a peculiarity of their capital controls.

In Argentina, wealthy individuals and institutions are not allowed to freely take money out of the country. They have to exchange Pesos for U.S. Dollars at a grossly unfair exchange rate. Recently, for example, the "official" government exchange rate has been around 350 Pesos to the dollar, whereas the actual rate on the street in the black market is about 1,000 Pesos to the dollar. Exchanging money at the government rate is akin to getting robbed in broad daylight. (Historically, agriculture and other natural resource sectors have been perpetual losers in Argentina due to having to sell their exports at the fake exchange rate to fund socialist programs in Buenos Aires).

If you're a financial institution, however, there's a clever way around these capital controls. This is that you buy stocks in Argentina, with Pesos, transfer the securities to New York, and sell them on the NYSE for dollars. Clean, simple, and effective.

Grupo Galicia (GGAL), for example, makes this point clear. Shares are selling for 1,300 Arg. Pesos, so about $1.30 each at the 1,000/1 black market exchange range. Galicia has a 10:1 ADR ratio, meaning each U.S. share equals 10 Argentine shares. Thus, if the price is set by the black market -- rather than the official exchange rate -- a share of GGAL stock on the NYSE should be ($1.30 *10 (ADR ratio) or $13 each. Sure enough, last quote Wednesday in New York was $13.50.

Why'd we just walk through that math?

Because there's a decent chance the Argentine Peso no longer exists in twelve months except as collectible memorabilia.

This leads to an obvious problem for institutions and traders in Argentina: What value does a stock have when its underlying currency is about to stop existing?

We need to start calculating what exchange rate the government will call in all the old Pesos at. There's been chatter that the Milei transition government wants to make everyone whole at 650 Pesos to the U.S. Dollar, which would be a sharp devaluation from today's "official" 354 rate, but way above what the black market is expecting.

Other foreign economists and analysts believe that Argentina is very low on dollar reserves or things to sell in exchange for dollars and that, as such, a dollarization rate will have to be a lot lower to make the math work. I've heard numbers closer to 1,800 to 2,500 Arg. Pesos each per dollar for the government to remain solvent and make the budget work in a dollarized economy.

If you own shares of YPF or Galicia or whatnot in Argentina, you now face a massive question. Do you hold share in Pesos, sell them now, or try to transfer them to the U.S. and sell for dollars?

Given the lack of historical examples to look to (very few countries have dollarized and even fewer have done so while having a meaningful local stock market), it's virtually impossible to speculate what will happen in the ultra-short term.

This is a nearly unprecedented "financial plumbing" question, and in the short-term, we could easily see Argentine stocks (listed in Argentina) trade up or down 25% without surprising me in the least. Having stocks quoted in a hyperinflating currency that is about to disappear is simply not a situation that we deal with very often.

As such, my rest of 2023 outlook for Argentine stocks is: ¯\_(ツ)_/¯

I will note, however, that the Argentine sovereign bonds have broken out to new 2-year highs and continue to rally, even as stocks have consolidated since their Monday gap up. Here's a benchmark 2035 Argentine bond:

In my view, it's just a matter of time until stocks catch up given that Argentina is a far more credible counterparty and place to invest than it was two weeks ago.

Once there is a clear path for how Argentina will dollarize (or Milei comes up with some alternative plan such as a Peso peg), that is when I expect Argentine assets to skyrocket.

Investors need certainty to make plans. Not knowing what currency, what exchange rate, or how transactions will clear six months from now makes it difficult to have a raging bull market. As soon as Milei lays out the new rules for the Argentine edition of Monopoly, people will start rolling the dice again.

There's no doubt that shock capitalism will look much more appealing than the 140% inflation and crippling regulatory state that Argentina is enduring now. As soon as people know the rules of the financial system, we will see a stunning move into Argentine assets. I'd remind you of how much Argentine stocks went up under a very milquetoast center-right president in the form of Macri. He was elected in late 2015 -- look how much the banks ran up after he won:

You can see how small the autumn 2015 "Macri wins" election pop ended up being compared to the run that would come following the vote.

Was Macri successful? Not at all. Argentina's economy keeled over again by the end of 2018. But investors will keep pumping money into a country that is going conservative until real-world evidence disproves the narrative.

Will Milei succeed? Who knows. He has a better shot than Macri did, but there will be a ton of opposition.

Have we enjoyed the Milei rally already? No, it hasn't even started.

And it might not really get going until early 2024 due to the financial plumbing questions discussed above. Once Milei sets up a credible economic transition plan and people start investing based on that new hyper-capitalist framework, Argentine assets are going to soar.

At this point, we need some patience to let them sort out the matter of dealing with the transition away from the Argentine Peso and getting assets denominated in a more trustworthy store of value, such as dollars.

And what about my top Argentine pick, Corporacion America Airports (CAAP), how is the outlook for that one?

The bull case, of course, is that it is trading at a massive discount to all other publicly-traded airport companies while posting great revenue and income growth metrics. And now, Corporacion America's former chief economist, Javier Milei, is president-elect of Argentina. Couldn't ask for a better fundamental set-up. Let's dive into the details though.

CAAP Earnings & Outlook

We'll start with CAAP's earnings. They have been entirely overshadowed by the election results, but earnings are earnings, it's worth a quick comment. CAAP stock did sell off sharply for about an hour on the Q3 earnings before people actually looked at the results and said, oh hey these were good.

The confusion came about due to the horrendous modeling of the company by the few analysts that cover it. I've done that rant almost every quarter so I won't do it again today.

I'll just note that the company's revenues of $469 million topped analyst expectations by $80 million. $80 million! That's a 20% miscalculation versus the actual result. And the traffic data is publicly available, this isn't that hard to model revenues. A random number generator would make equally useful forecasts.

For Q3, CAAP's top-line revenues grew 19% while operating income skyrocketed 42% and EBITDA surged 32%. The company is continuing to execute to perfection while enjoying tailwinds from Argentina's resurgent travel industry. Not too complicated.

So why did CAAP stock sell off 5% on the open following the results? In Q3 2022, they had a gain on foreign exchange translation. This quarter, they had a loss. Despite operating income rising 42% y-o-y, EPS did not follow suit due to the favorable FX event in 2022 turning into a drag now. Assuming all FX gains and losses average out in the end, that's a non-story. And the market, rightly, treated it as such.

That said, CAAP stock should have been up on earnings given the tremendous earnings results, rather than merely being flattish. Shares are around $13.25 as I'm writing this, which is a nice bump from last week. But the stock was at $14 prior to the previous round of the Argentine presidential election -- it sold off sharply on the fears that Milei was going to lose.

Now that he in fact won and CAAP delivered yet more tremendous revenue and operating income growth, the stock should be a lot higher than it was this summer. Call remains the same as prior, this is a $20+ stock next year.

CAAP stock would have to be closer to $30 to get its valuation in-line with where the Mexican airports are, and that assumes no additional EBITDA growth, that's just on today's results.

Argentine assets deserve to trade at a discount to Mexico -- sure -- but less of one than before given the recent Mexican intervention in their aviation markets combined with Argentina's sprint toward hardcore capitalism. CAAP stock remains the obvious way to have tremendous leverage to the Argentina theme while owning a high-quality asset at a silly cheap multiple. Downside is limited even if Milei ends up being an underwhelming president, and the stock is a multi-bagger from here if Milei can gain any traction with his reform agenda.

So other than CAAp what do you like in Argentina.

Hi Ian , thanks for the update. I didn't see a weekend digest last weekend and this update seemed really brief and left wanting more. I would have expected you to provide a more detailed overview of which Argentinian securities you are watching closely. I listened to your twitter space last weekend after Milei won and honestly felt like I got more information listening to that, than this write up. I am new sub ,trying to understand what to expect . Thanks